Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Sloshing the Bull

The US equities have been cycling through themes and memes. A sort of sloshing about as the overall water level continues to rise. It’s not the same old market as the last time techs rallied. Beneath it all is weirdness – the memes – that unsettles the market players.

The algos appear now to be based on relative performance vs. some statistical statement about over valuation. This past week, for example, mid-cap S&P 400 (MDY) which had underperformed from March led indexes higher at +1.94% vs. SPY +1.40%.

Previously this has felt like a leveling process. It’s the first-one-now-will-later-be-last market while the underlying trend remains bullish.

Just buy the one with the lowest valuation and best relative price regardless of what it is. Supporting evidence is the leading sector for the past week was utilities (XLU) gaining +3.69%.

As well as XLU did, it was not among S&P sectors hitting new 52-week highs. All the S&P sectors hit new highs EXCEPT, XLU, carbon energy (XLE), and communications (XLC). That’s some large cap muscle. Diverse contributions from many directions. A multi-vector market as it were.

Over the past month consumer discretionary (XLY) has led at +7.71% while technology (XLK) is second at +7.32% vs. SPY of 5.74%. That’s reopen trade. This week we added some spark in healthcare (XLV) up 3%.

There is apparent performance convergence forming as we rotate constantly between sectors. Growth (IWF +1.80%) and value (IWD +1.18%) along with low volatility (SPLV +1.99%) were all up in the same week. Everything has been going up but the arbitrage is in the timing and whose turn is next.

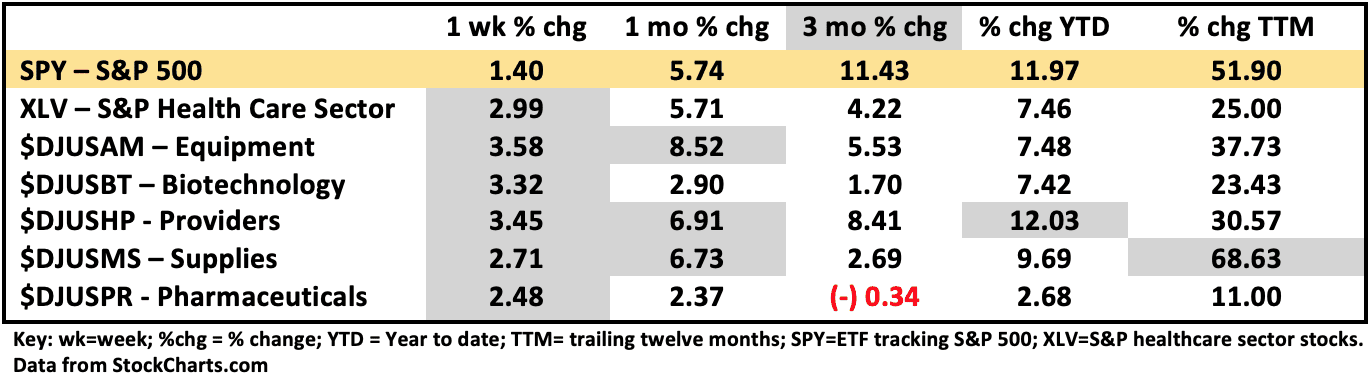

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 4/16/2021

Healthcare (XLV) woke up this week, gained +2.99% and outperformed SPY at +1.40%. Examining the charts XLV began to show improvements in price momentum in March which wasn’t manifested in significant price change until about three weeks ago where it stayed stuck. This past week there was a price trend breakout that has been confirmed so far. This implies the move may persist longer than what we have seen so far.

Driving this bullish move overall are three sectors which also sprang to life. Equipment ($DJUSAM) +3.58%, Providers ($DJUSHP) +3.45%, and Biotech ($DJUSBT) +3.32. Some of this outperformance is lengthening into the one-month performance. The next tell will be pushing the bullish moves into the 3-month %-change chart, again implying both strength and persistence of the move.

These changes don’t come with an explanation manual but we can infer some likely explanations at least for the short-term move. The overall bull market has been rotating frequently between S&P sectors often seeking the lowest price or best valuation scenario. Sloshing the bull. XLV and its components have been underperformers for over a year. In market speak this could just be a technical move.

But maybe not. Some of this makes sense in the context of what most believe is happening. In recognition of the value of the vaccines, Novavax (NVAX) gained +26%, BioNTech (BNTX) gained +24%, and Moderna (MRNA) gained +21% on the week. Even big Pfizer (PFE) gained +5.38%. And J&J (JNJ) didn’t lose. The winners are beginning to win finally. Equipment stocks showed broad participation to the upside in the large and mid-cap groups. And for providers, as well as United (UNH) did at +3.91% on earnings, Humana and Anthem did better. This fits with the reopening trade story. But next week we might rotate again.

As I See It: This market is as bullish and as overbought as it has been in a couple of decades though the monetary and fiscal backdrop are much different now. The huge money is rotating this way and that as we continue to slosh the bull.

April 19, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.