Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Our intent is to educate you in useful ways of thinking about the public healthcare markets including the explosion in 2020 of healthcare IPO’s and digital health, devices, diagnostics and therapeutics along with other technologies and innovations in healthcare payment and delivery.

How to Know When Conditions are Good

Individual stock prices are significantly impacted by the movement of their sector classification, in this case healthcare (XLV), and by their industry segment classification such as biotechnology ($DJUSBT).

Market movement can be tracked by standard stock index groupings and by ETF’s (exchange traded funds) that follow an index or grouping. This will form the basis of this analysis.

We are in a time of great innovation and commercial excitement in digital health, biopharma, and medical devices. Market acceptance of these innovative approaches is accelerated by Covid-19. These and the companies in the insurance and provider segments form the basis for our analysis and educational insights.

In 2020 there has been unprecedented levels of investments in all stage companies in healthcare. And some segments of the publicly traded healthcare firms have largely outperformed the broader market. Early stage healthcare companies have never had a more fertile environment to develop and grow and to participate in an expanding market. Healthcare is a foundational technology now and for the future.

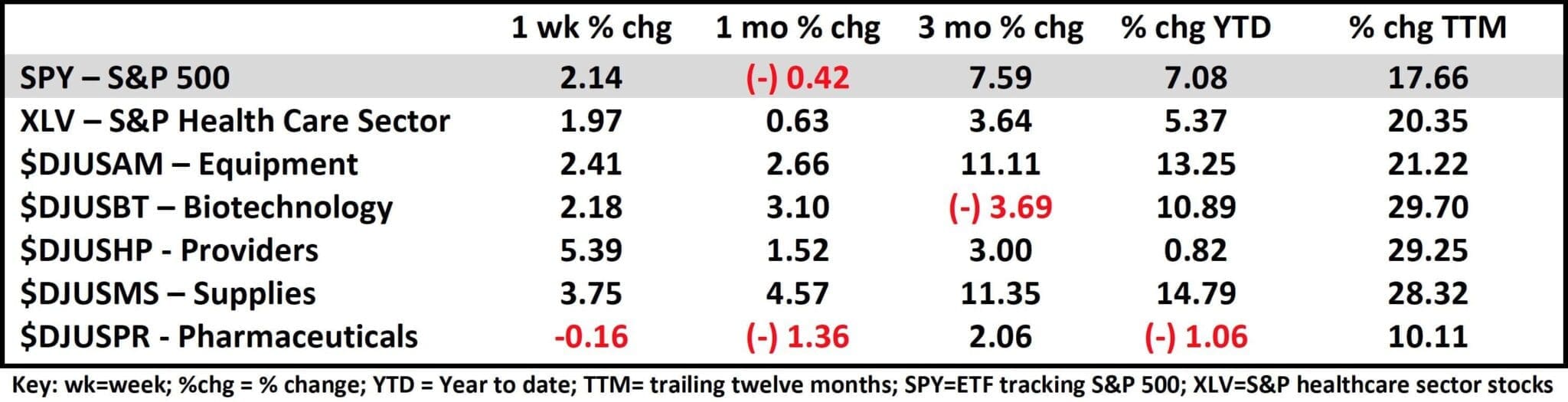

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of 9:40 AM CT 10/6/2020

XLV, the S&P healthcare sector, outperformed SPY from 2017-2019. From January 2019 to October 1, 2020 XLV has underperformed SPY with periods of outperformance.

Who cares? If you have a company and you may want to sell it to a larger firm in the public market, it is helpful if these public companies are financially healthy. One metric is relative performance against the benchmark (SPY). It helps determine what market participants might pay for your company or incremental revenue from your product if consumed by a larger company.

Big Pharma ($DJUSPR) consistently performs below the other segments of healthcare in recent years. Despite lots of ink and talk, big pharma most of the time barely grows faster than the economy. We will explore over time why this tends to be the case.

In the 2020 Age of Covid Biotech ($DJUSBT) has had the highest outperformance over the trailing twelve months. But YTD biotech trails equipment ($DJUSAM) or supplies ($DJUAMS) segments. That’s a little unexpected, though biotech is less certain, more risky, and more volatile.

The equipment segment, a relatively dynamic segment of the healthcare market today, contains stalwarts like Boston Scientific (BSX) and Medtronic (MDT) but also, brand new entries like Nano X imaging (NNOX) and Pulmonx Corp (LUNG) a recent IPO.

Medical supplies also has a range of companies from Becton Dickinson (BDX) to Cardinal Health (CAH) and IDEXX Laboratories (IDXX) to Tilray (TLRY) that cover manufacturing, distribution, and more.

As I See It: There has been perhaps no more interesting time to be building and growing a healthcare company as it is right now. The public market is robust. Market acceptance of innovation and new therapeutics and process automation as well as advance computing and analytics including AI/ML is unprecedented. Join us every week for a quick overview of these markets to help you plan the growth and success of your company.

October 6, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.