Funding announcements in health innovation have been coming in hot and fast these days. It’s easy to lose perspective about where we’ve come from and where we’re going. This 2021 midyear StartUp Health Insights Report (something we’ve been doing for a decade) is an essential opportunity to step back, take a beat, and view the market with a longer lens. What’s the 10,000-foot view? We also take this opportunity to look at funding trends from a health moonshot perspective. Are we investing in the tools and services that will increase access to care, cure disease, lower cost, and achieve the other global goals that can improve the lives of billions of people? Let’s look at the numbers.

The Covid comeback from a year ago has continued and accelerated

One year ago, in the 2020 StartUp Health Insights Midyear Report, we closed out the most-funded six-month period on record. That report came at the height of the first wave of the COVID-19 pandemic, back when all bets were off. Lockdowns caused markets to freeze, and it was anyone’s guess how quickly they’d thaw.

Now, looking back, it seems almost obvious that health innovation bounced back quickly. After all, in a contactless, virus-filled world, what do we need more than telemedicine, remote monitoring, and app-based mental health? But at the time, it was anything but certain. Early in the pandemic, in analyzing the first quarter’s banner funding, MedCity News wrote that “faced with a global pandemic, the trend is unlikely to continue.” As famed investment analyst Yogi Berra put it, “It’s tough to make predictions, especially about the future.”

After a moment of panic (for pretty much every market on every continent) health innovation began an upward climb in both adoption and investor interest. That up-and-to-the-left trajectory kicked off one year ago, continues today, and has accelerated significantly.

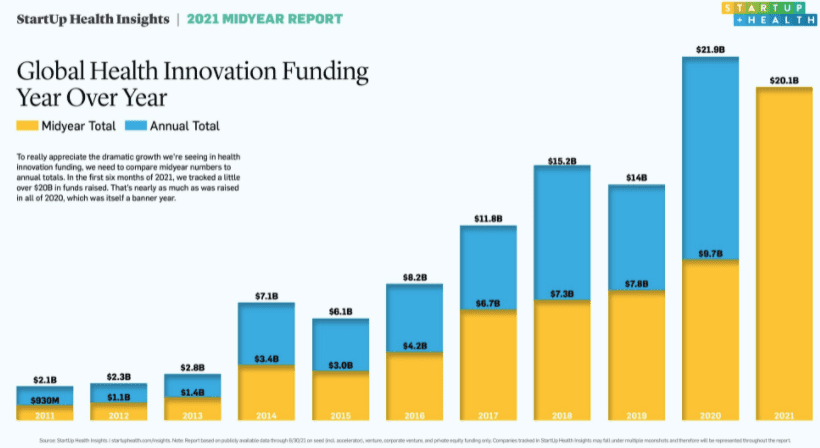

Total funds raised skyrocket, fueled by ceiling-breaking mega deals

The biggest headline from this midyear report is the total funding number. In the first six months of 2021, we tracked a little over $20B in funds raised. To put that in perspective, that’s nearly as much as was raised in all of 2020, which was itself a banner year.

Investors: Learn how you can invest in Health Moonshots through StartUp Health’s new rolling impact fund.

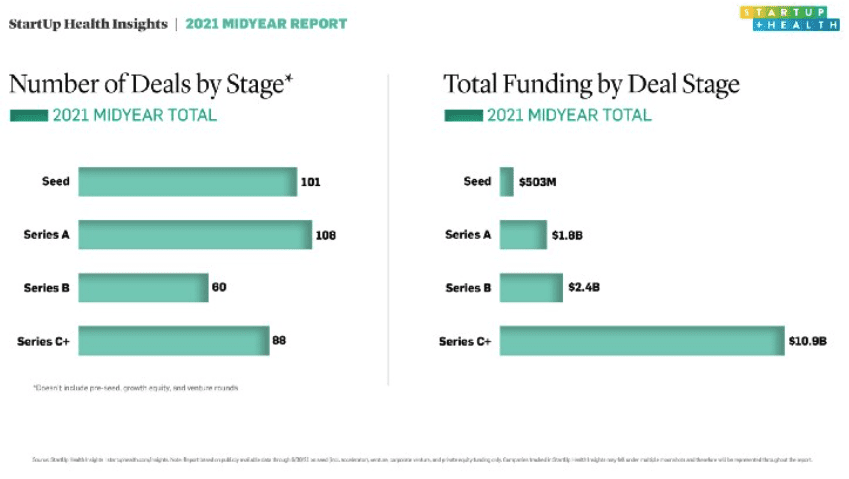

While money has flooded the health innovation market in 2021, the number of deals has risen more gradually. That’s because we’re seeing more and more blockbuster mega deals. The biggest investment deal in Q2 was a mammoth $600M raise for CMR Surgical. We’ll get into why this specific raise is meaningful below, but for now, suffice it to say that deals this large (this one deal is half of what was raised in all of 2010) have the effect of changing the landscape. They alter the atmosphere, break ceilings, and redefine what is possible. How big and impactful can a health innovation company become? How much are we willing to invest to achieve healthy moonshots? We’re finally seeing the kinds of funding numbers that will begin to test this question.

Top Deals

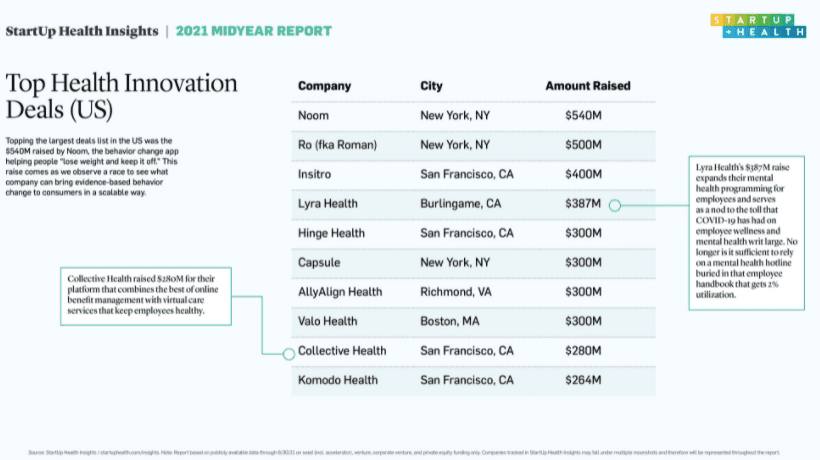

In the name of following-the-money, we look to our Top Deals list, both in and outside the United States, to learn how market priorities are shifting. The first thing that stands out is the diversity within the list. In past reports, we saw the Top Deals list dominated by just a couple areas of health, like home fitness and patient engagement. Before Covid shook up the market, the sense was that only certain kinds of health innovation companies were scalable and profitable enough for massive investment. Now, that’s changed. In this report, we see record-breaking mega deals in weight loss, telemedicine, drug discovery, mental health, pharmacy tech, research, insurance tech, and more. We’re seeing money flowing into consumer and B2B, to labs, and to laymen. That’s the reality both inside and outside the United States. Perhaps we’re entering a period of creative growth (and risk-taking) where potential is measured less by past market performance and more by health moonshot vision and true global needs.

For the first time ever in the 10-year history of this report, the largest deal for the period came from outside the United States. CMR Surgical, based in Cambridge, England, raised $600M to expand access to its robotic surgery system, called Versius. This is notable not just for the gobsmacking size of the raise but because it’s an investment in bleeding-edge medical hardware. Typically deals of this size have been reserved for high-profit consumer products (like Peloton) and insurance platforms that cover millions of lives (like Bright Health). The fact that the last quarter’s biggest fundraise breaks open an exciting new field in high-tech remote medicine speaks volumes about the health moonshot mindset — and appetite for risk — in health innovation investing. Whether this big UK raise is the beginning of a pattern, a shift in investment focus, or an energizing of investment in Europe, has yet to be seen.

Topping the largest deals list in the US was the $540M raised by Noom, the behavior change app helping people “lose weight and keep it off.” This comes as little surprise because for the last few years we’ve witnessed a race to see what company can bring evidence-based behavior change to consumers in a scalable way. This is low-tech territory (“eat this, not that”), but the potential impact couldn’t be higher. Whoever can crack the code on things like weight loss, sleep, and exercise can save or improve millions of lives while reducing healthcare costs by untold billions. While Noom tops our list today, it’s just one of many entrants taking a crack at the daily behaviors that contribute to obesity, type 2 diabetes, and heart disease. Where the sector will shake out, or how it will consolidate, is still anyone’s guess.

Other notable mega deals for the second quarter of 2021 include Lyra Health’s $387M, raised to expand their mental health programming for employees. This raise serves as a nod to the toll that COVID-19 has had on employee wellness and mental health writ large. No longer is it sufficient to rely on a mental health hotline buried in that employee handbook that gets 2% utilization. Companies like Lyra (and StartUp Health portfolio companies Rose Health, Hurdle, and wayForward) are presenting novel, tech-enabled solutions to meet employees where they’re at in their burnout, anxiety, and stress.

“Employers are now listening to their employees and adding robust mental health care offerings to meet growing expectations,” says Kavi Misri, CEO and Founder of Rose Health, which joined the StartUp Health portfolio in 2020.

Swedish startup Kry raised $312M to expand its telemedicine offering in Europe. The company saw a 100% increase in adoption last year, even though healthcare usage was down overall. Post-pandemic, when people play catch-up with their health and come back to providers en masse, Kry will be ready with a new way of doing business.

Two deals topping our lists focused on upgrading how people get their prescription drugs. In India, PharmEasy raised $323M to expand the availability of their pharmacy app, while in the US, Capsule raised $300M to do similar work. Two deals that topped $200M focused on rethinking how insurance is handled. Collective Health raised $280M for their platform that combines online benefits management with virtual care services that keep employees healthy. Alan, a startup based in France, raised $220M to expand its insurance tech platform that is designed for the European markets. This single-payer environment hasn’t encouraged a lot of insurance innovation in the past, so we’ll be watching to see how Alan marries the worlds of government-run healthcare and independent, tech-enabled apps. What will the European version of insurance tech look like, and could it serve as a leapfrog moment for American insurers?

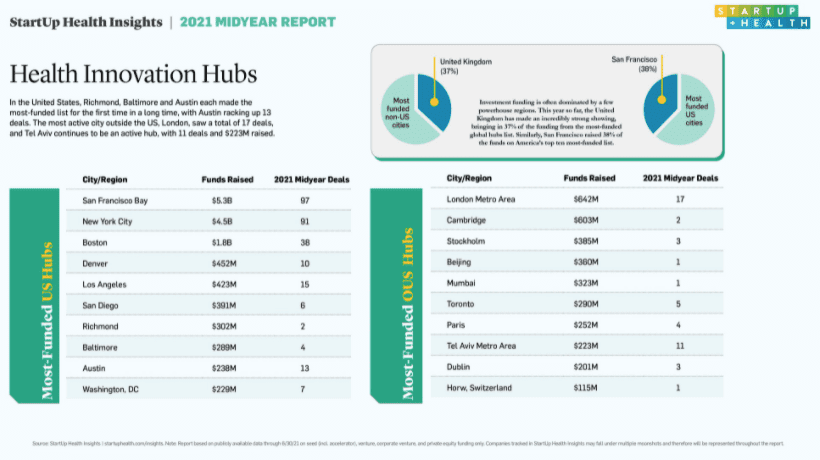

Hubs of Innovation

While the list of most-funded US cities has its usual suspects at the top (San Francisco, New York City, and Boston), there are a few notable newcomers. Richmond, Baltimore, and Austin each made the list for the first time in a long time, with Austin racking up 13 deals. That makes Austin the fifth most active city in the US in terms of health innovation deals. Put together, the Mid-Atlantic trifecta of Philadelphia, Baltimore, and Washington DC accounted for $714M in funding and 18 deals, which is a sharp uptick for the I-95 corridor. Continuing strong is Los Angeles which posted 15 deals and $423M raised for the quarter.

The most notable feature on our list of most-funded cities outside the US is the low deal count. Compared with San Francisco’s 97 deals and New York City’s 91 deals, the most active city outside the US, London, saw a total of 17 deals. Three cities that made this list only posted a single deal, and most relied heavily on a single mega-deal to make the list. That said, Tel Aviv continues to be an active hub, with 11 deals and $223M raised, as does Toronto with five deals and $290M raised.

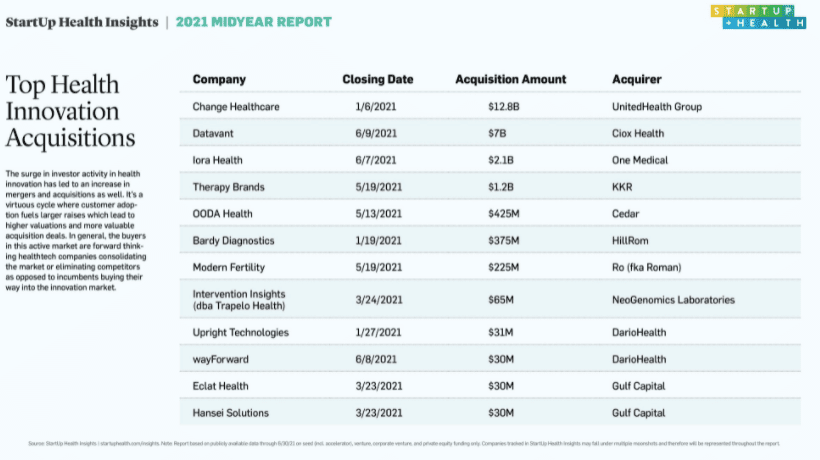

Exit Activity

Not shockingly, the surge in investor activity in health innovation has led to an increase in mergers and acquisitions as well. It’s a virtuous cycle where customer adoption fuels larger raises which lead to higher valuations and more valuable acquisition deals. The second quarter of 2021 saw three separate billion-dollar M&A deals in the sector compared with just one billion-dollar M&A deal in Q1 2021. Topping the list was a $13B acquisition of Change Healthcare by United Health Group, followed by Ciox Health’s $7B acquisition of Datavant. In general, the buyers in this active market are forward-thinking health tech companies consolidating the market or eliminating competitors as opposed to incumbents buying their way into the innovation market. We saw that with One Medical’s acquisition of Iora Health, Cedar’s acquisition of OODA Health, and Ro’s acquisition of Modern Fertility. We’ve written for years about the healthcare platform race, and we’re seeing that consolidation happen at an accelerating pace.

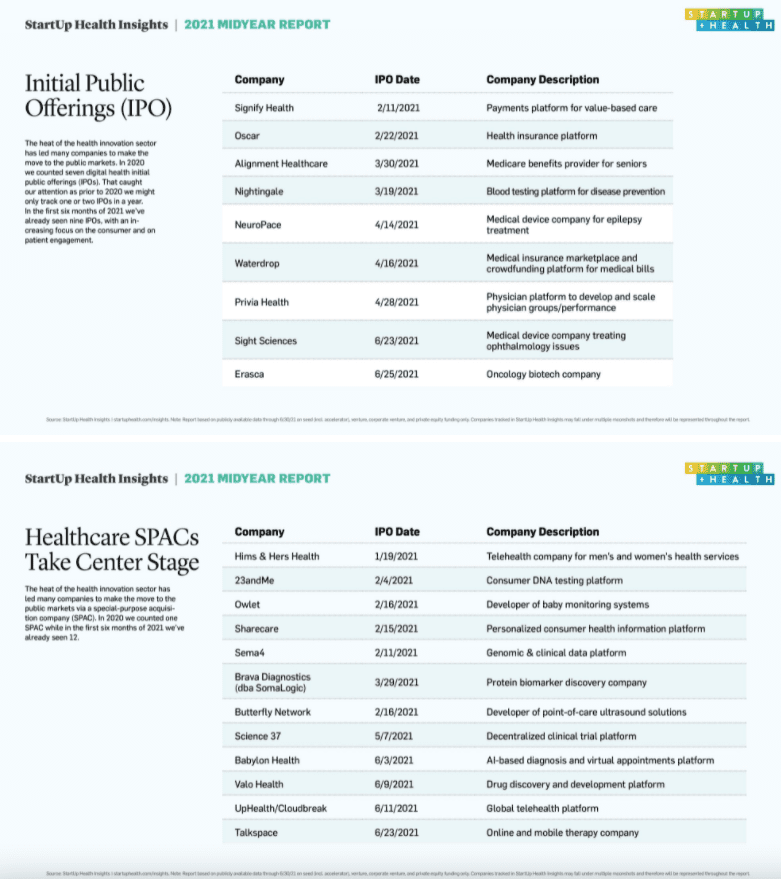

The heat of the health innovation sector has led many companies to make the move to the public markets. In 2020 we counted seven digital health initial public offerings (IPOs) and one SPAC. That caught our attention as prior to 2020 we might only track one or two IPOs in a year. In the first six months of 2021, we’ve already seen nine IPOs and 12 SPACs. Notably for the StartUp Health family, on June 9, Cloudbreak Health (which StartUp Health backed in 2017) completed a business combination with UpHealth Holdings, Inc, as part of a SPAC transaction led by GIGCapital.

“This combination gives us the opportunity to live our mission on a global scale, resolving health disparities, reshaping healthcare, and powering its digital transformation,” said Jamey Edwards, CEO of Cloudbreak Health.

Across both IPOs and SPACs we’re seeing an increasing focus on the consumer and on patient engagement, with companies like Sharecare, 23andMe, Babylon Health, and Talkspace (the first publicly traded pure-play mental health company).

Top Investors & Dry Powder

So far in 2021 investment firms have raised more than $196.4B in new capital, compared to $94.7B during the same period in 2020. That’s a 107% YoY increase. That dry powder signals that health innovation investors have the ability to invest quickly, and at higher levels, to both support the increasing number of healthcare entrants seen in the marketplace as well as continue funding the winners through scale.

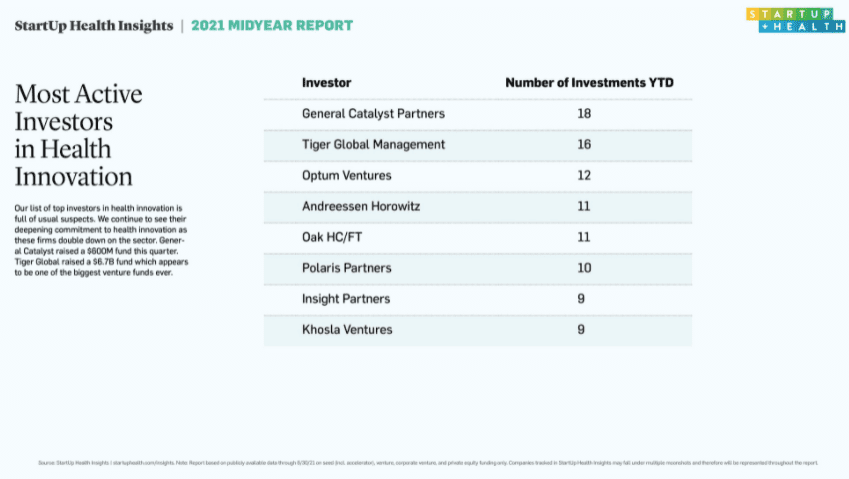

Our list of top investors in health innovation is full of usual suspects, like General Catalyst, Tiger Global, Optum Ventures, and Andreesen Horowitz. We continue to see their deepening commitment to health innovation as these firms double down on the sector. General Catalyst raised a $600M fund this quarter. Tiger Global raised a $6.7B fund which appears to be one of the biggest venture funds ever.

Conclusion

For most of a decade, we at StartUp Health have beat the same drum. Together we can achieve health moonshots, but it’s going to take a kind of investment that we’ve never dreamed possible. This report’s record funding numbers, which far eclipse last year’s banner numbers, are finally beginning to crack the surface of what we believe is possible.

Another important theme in this report is the globalization of every major health innovation sector. Insurance tech saw a major raise from France-based Alan; pharmacy tech saw expansion in India with PharmEasy. Telemedicine lays new foundations in Europe with Kry’s raise, while Canadian homecare startup AlayaCare raised the kind of capital needed to expand into the US market. While this activity has been happening for years, what is significant is the investment amounts — each raise mentioned above is in the hundreds of millions, a level previously unheard of outside the US. We’re thrilled to see this trend because health moonshots know no boundaries and we have to be in this fight together.

Does this report signal the beginning of a long-awaited and much-needed shift in investment priorities towards Health Moonshots and global health goals? We certainly hope so. Keep tabs on health innovation funding each week on our blog, and we’ll be back next quarter with more analysis.