2022 Health Tech Recap – The Trend is Still Your Friend

Despite a tough year in 2022 for health tech early-stage companies and markets in general, the trend that took flight in 2020 and 2021 in

Despite a tough year in 2022 for health tech early-stage companies and markets in general, the trend that took flight in 2020 and 2021 in

Here are some key takeaways for those who missed Green Room Technologies’ recent webinar on D2C Healthcare sponsored by MedleyMed. The webinar was geared for

Crypto or biotech – Both are high risk and high reward investments. Bob Teague, MD layouts out the pros and cons for investors battered by

DexCare, the digital care operating system that was spun out of Providence Health last March, has raised $50 million in series B funding for its

We know that the US health market is different, peculiar by world standards, and incomprehensibly complex. We know that it is difficult to understand as

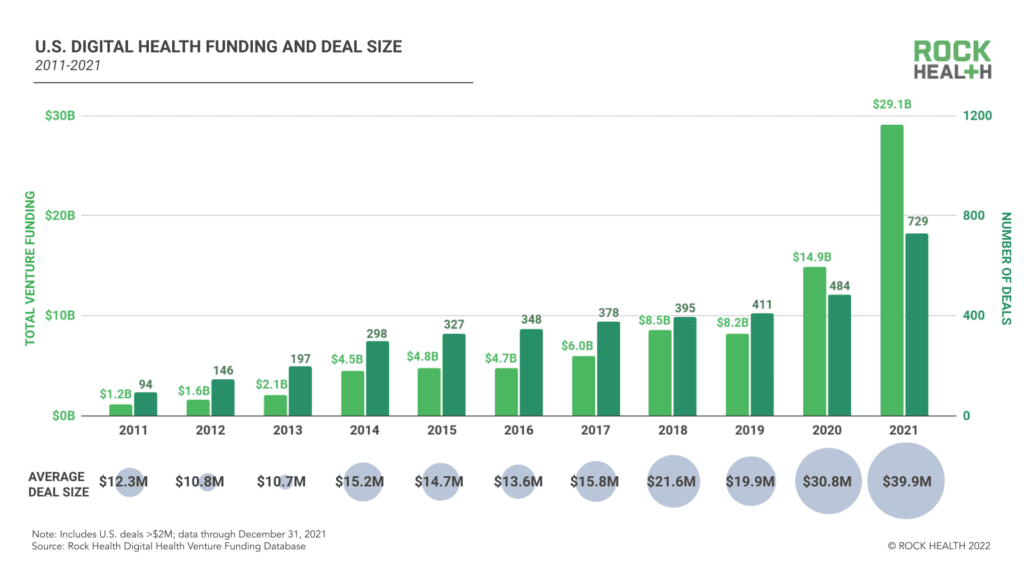

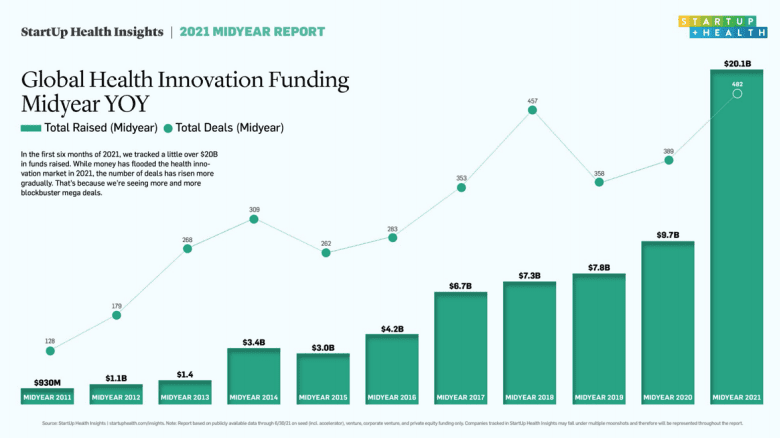

If you’ve been following our updates, you know 2021 was a (the!) year for digital health venture funding: In July, we reported that the year

A closer look at the funding vehicles driving the VC-backed health tech and biotech markets and the pitfalls for the average investor entering 2022

A look back on the year that was for the healthcare industry and peek ahead for the digital health market in 2022 as we enter

Funding announcements in health innovation have been coming in hot and fast these days. It’s easy to lose perspective about where we’ve come from and

Providing broad access to virtual care seems like an obvious thing to do. And it looks like CMS is at least considering this expansion. The

PO Box 637

Austin, Texas

[email protected]

By providing your contact information you consent to receiving emails & information from Green Room Technologies.

No Spam. We respect your privacy & you may unsubscribe at any time.