Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Contained Corrections

As we continue through market adaptations in the Age of Covid it has become common to comment upon market resilience. Perhaps this reflects our own. Corrections when they occur have remained contained by the algos that buy the dips.

Other characteristics of this period have included corrections in overbought sectors or instruments resulting in mechanical rotations among industry groups based on relative valuations, tic-by-tic machine-traded binary reciprocal relationships like predicted inflation and growth, minor pullbacks, continuation patterns of various lengths, and headline-reading machines that cause air pocket events like the reaction to the announcement that the current administration may want to raise taxes. Only the algos were surprised apparently.

Somehow this has all happened without precipitating a major crash or correction even in QQQ. The constant rotation seems to be causing performance convergence across multiple indexes.

Taking the market from a perspective of one month shows the performance convergence with SPY +6.99%, QQQ +7.00%, MDY +8.56% and IYT + 8.81%. Weekly rotations aside, this combination of positive outperformance is a good platform for bullish continuation especially if current technical features resolve upward which is partly dependent on earnings and evolution of adaptive Covid macroeconomic picture without any new disasters.

What’s a market to do? Both monetary and fiscal policy are set to promote economic growth. Both markets and individuals by these machinations have so far contained corrections when they have occurred.

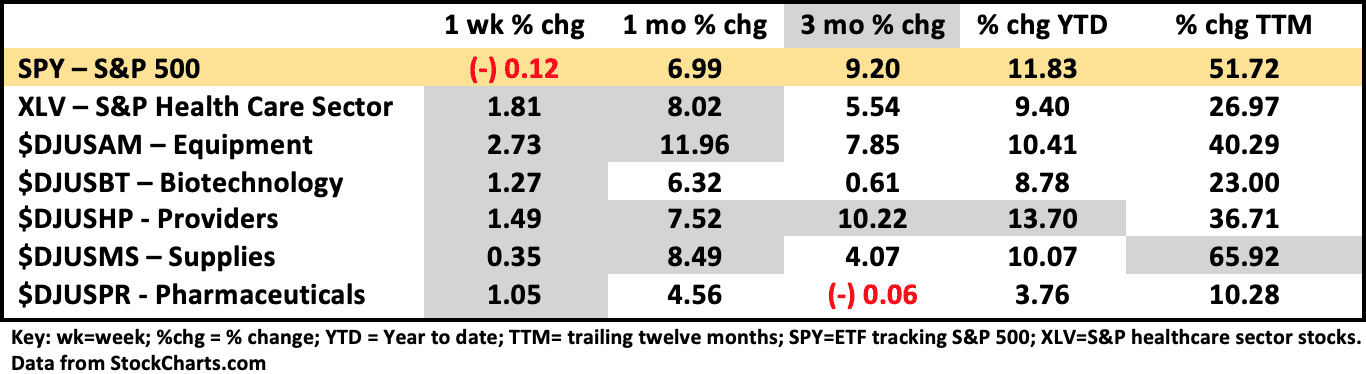

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 4/23/2021

Healthcare (XLV) gained for a second week at +1.81% and was the second-best performing S&P sector. For the past three months, or in the intermediate term, healthcare stocks have been incredibly weak except for providers ($DJUSHP). Besides a large increase in price momentum for XLV another indication of strength has been net stock accumulation for about the past month. This is still considered short term but suggests a longer upward move may occur.

Leading the provider space over 3 months have been large cap players Anthem (ANTM) +22%, HCA (HCA) +22%, and United (UNH) at +16%. The leader in the Small cap area was The Joint Space (JYNT) the chiropractic operator at +82% over the three months. Surgical Partners (SGRY) the integrated surgical services operator was +56% while senior living centers like Capital (CSU) and Brookdale (BKD) also booked big gains. This all seems indicative of both recovery of more business-as-usual care activity as well as good adaptive execution through an extreme period.

The sector that seems to be picking up a significant momentum is equipment ($DJUSAM) at +12% over one month vs. SPY at +7%. This sector has had great growth over the past five years and has been second only to supplies ($DJUSMS) over the trailing 12 months while underperforming SPY. Leading the large cap equipment companies for the week was Intuitive Surgical (ISRG) the minimally invasive and robotics firm that gained +7.75% on a good earnings report. Over one-month ISRG is up +23%. This appears to be an early indication of increasing activity in procedures and care delivery as Covid care decreases.

As I See It: The bull continues with a remarkable resilience by algos either buying on dips or selling extreme activity and valuations even in the themes and memes (crypto, SPACs, NFT’s and Reddit stocks). As with all trends, they continue until they don’t. Stay tuned.

April 26, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.