Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Nothing to Do but Nothing

There are times in the stock market when despite hype and anticipation not much changes at the top line index level. And how could it until the current dynamic is broken?

The indexes are bumping along at or close to all-time highs bounded by overhead resistance while protected by algos buying the dips, a flood of money that has entered equities, and continuation of the cheapest money in history.

This is what happens when the market stakes a position and it turns out to be right. Momentum slows and internal rotations or the sloshing effect continue until a new direction is declared. The market not moving much except in the same way as the cleaning cycle of a clothes washing machine simply means there is not a dominant opinion about what happens next.

Sometimes there is nothing to do but nothing. When will we know to move? We will know when it happens, whether there is energy to move up some more or whether there is a leg of the recovery story being sawed off. Until then we have fretful internal correcting.

In the past week we had fractional moves with QQQ ($NDX) again selling off more than other indexes. Investors in the main took the opportunity to sell the good news of great earnings from the Big Five (AAPL, GOOGL. FB, AMZN, MSFT). GDP performed in line with expectations, and we got SPY +0.13%, QQQ (-) 0.42%, MDY (-) 0.72%, and IJR (-) 0.33%.

A flat week in the markets. We continued many continuation patterns and short-term price ranges. Sideways is the new up. Things will change soon enough. The lean is bullish. The risk is bearish.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

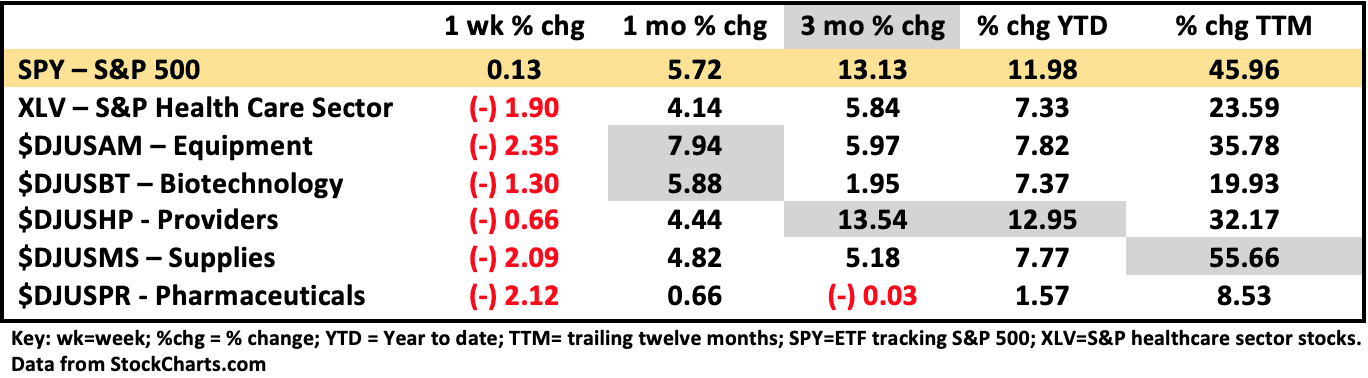

Healthcare Segment Scorecard - as of close of market 4/30/2021

Healthcare (XLV) gave back one week of its recent gain. The healthcare stocks have been mainly marking time since January 2021. At the sector (XLV) level they have not gone down appreciably either. But internal to the sector there have been major corrections going on. The three weak areas which in some ways seems surprising are the usual marque performers: devices ($DJUSAM), biotech ($DJUSBT) and pharma ($DJUSPR).

The healthiest performance comes from the provider group ($DJUSPR). Each one of the weak performers and the providers may have different flavors of the same headwinds. Their stocks reflect diminished Covid effect and return to BAU vs. slow revenue growth, challenged margins, and geopolitical risk in the form of proposed changes in taxation, proposed price competition, and regulatory changes. Covid-related stocks have performed the best through this time. Big pharma ($DJUSPR) with some notable blow ups recently and overall terrible execution in this difficult environment have not been a good place to be if you had no vaccine.

Healthcare stocks have been behaving so poorly it makes us wonder if this time there will be actual finance and delivery reform in healthcare. We have been seeking it for decades. It usually gets more talk than action. But these business models are so ineffective now perhaps there is an opportunity that the firms and their lobbyists could support.

What makes the healthcare market so different and difficult? Unlike a usual commercial market, the buying and selling and transacting do not take place between the same two parties. There is a third party involved. The healthcare market is extremely complex and non-intuitive. This is no lemonade stand. It’s very different from the way we normally experience a marketplace. This impacts stock perception and behavior.

As I See It: It was a strange week. The market was right about the numbers. When the predicted happened, not much happened at the headline level but there was quite a bit of movement under the surface of the market. Sloshing continues. The market is clearly leaning bullish. The risk is bearish.

May 3, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.