Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

We Rotated, Now What?

Not only did we rotate but the Wall Street Journal noted this weekend that retail investors went away this past month and didn’t spend their new guv’ment money on stocks. Oh, you cynics! Another fabrication bites the dust. Apparently the choice was between call options and burgers, preferably in person.

The chattering class which heretofore (pre-2021) was sipping their tea and was pretty happy with no bounds on guv’ment largesse either in spending or tax cuts are tut-tutting now about infrastructure spending which in the view of many is about 50 years overdue. We could call this Austerity and Bust. Even the redoubtable Reinhart and Rogoff way back in 2009 pointed out that over eight centuries of guv’ment financial screwups not only did austerity seldom work it seldom was attempted.

The week in stocks was an across-the-board rally. The Nasdaq 100 (QQQ) led the way gaining +4.25%. Large cap technology caught a bid as earnings season approaches and after a 6–8-week correction-continuation pattern. The SMID’s, those other growth harbingers, also did well with IJR +3.19% and MDY +3.15%. SPY, the benchmark, gained +2.80%.

The S&P sectors have already rotated in a sense. New 52-week highs this week occurred for industrials (XLI), materials (XLB), and REITs (XLRE) all anticipating the expected pop in economic expansion. It’s not a bad setup going into earnings. Bullish without too much exuberance.

That said, on the week, technology (XLK) led the week gaining +4.71%. XLRE was second at +2.98% on the week and was +8.40% on the month. What this looks like to me is a leveling process prior to earnings

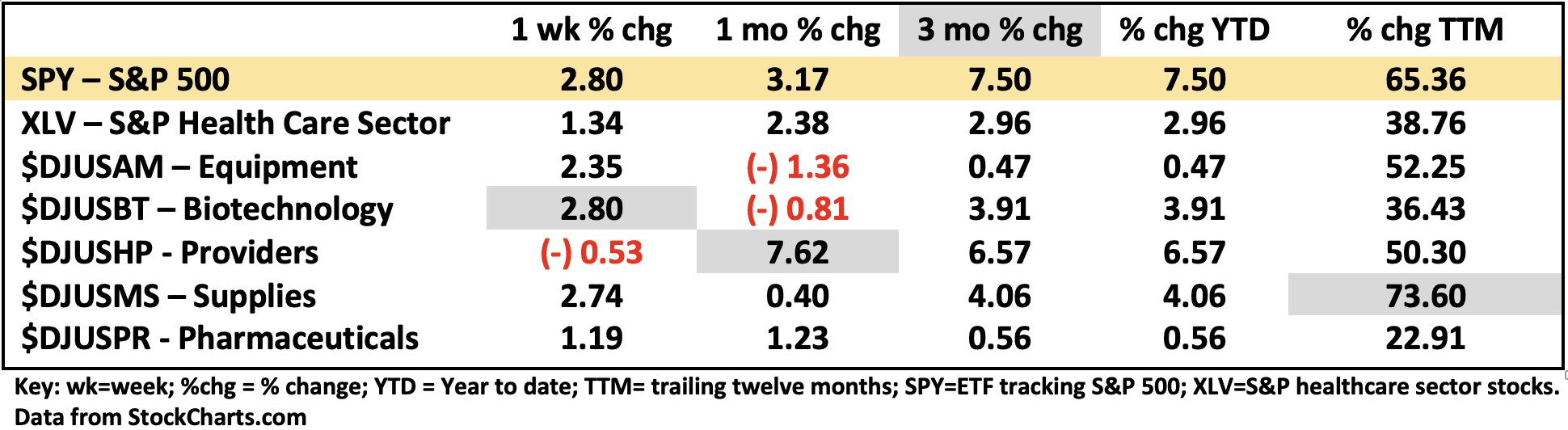

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 4/2/2021

A little earlier I said the week in stocks was an across-the-board rally. I meant to say, except healthcare (XLV). We can enjoy the rising markets lifting all boats effect since XLV and in fact all the S&P sectors gained on the week. But we can’t really say healthcare stocks rallied. We are stuck in a correction-continuation motion that has now gone since January. It’s tedious to say the least. Biotechs ($DJUSBT) have corrected the most and had a little gain last week but nothing to write home about. More of the same bleh.

We suppose this boring action is related to uneven performance of individual stocks and significant uncertainty about the Covid pandemic itself actually receding given the rise of new variants and accelerating cases around the country. And to some extent we will need to see the dust settle after the critical phases of the pandemic end and we can reassess the businesses of payers, providers, and the biopharma complex to see how and how fast business as usual may be restored. Can we extrapolate? Or do we need new models for new times?

Since the biotechs ($DJUSBT) have sustained the most correction and the common ETF’s used to invest in this sector – XBI and IBB – have corrected significantly, XBI into bear market pattern, there was a bit of life in the broader sector this week suggesting perhaps that there could be a turn or at least a sideways continuation awaiting economic news, pandemic news, and earnings news.

It didn’t help this week that Emergent BioSolutions which lost (-) 14% on the week was involved in a manufacturing fail of the J&J vaccine. This may have helped BioNTech (BNTX) gain 20% on the week. Pretty wild price swings. Some of the digital companies in healthcare performed ok this week. Schrodinger (SDGR) a pharma simulations software gained +13% this week as one example.

As I See It: A bullish week anticipating economic growth and earnings growth. We better see some! Many people are worried about many things. That’s fine. Tech has made a bullish move. Leveling looks about done. Bring on the earnings. Let’s see what you got. It should add clarity to healthcare stocks tool.

April 5, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.