Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Testing. Testing. 1-2-3

It was open mic week on the US stock market last week. Must be the Spring Break effect. There was nothing particularly coherent about the trading theme. We rolled with one story and another. A few of the routines this week included:

- Liquidity. Too much? Slowing growth of liquidity? What happens next? SPACs of course.

- Inflation. Too much? Too little? Are we really in 1971 as some suggest? Please, no!

- Taxes. You can fill in this blank. This is a figment. Nothing has happened yet.

- Debt. Deficits. Admittedly we are in uncharted territory.

- Bond bulls vs. bond bears.

- Speed of economic growth. What if it’s too hot?

Ok. You get the idea. With no dominant theme and no real news except crashing a container ship in the Suez Canal, we were all over the map where we sold down three sessions, a reversal on Thursday and a drop the mic moment on Friday. In the end it was somewhat entertaining. Big stocks gained. Small stocks continued a two-week correction.

Uncertainty drives. We probably more or less have the macro direction pegged correctly as the post-vaccine Covid market takes shape. But pace of change, timing of changes and the detail around changes is pretty much the Rorschach of the moment. If Dow Theory still applies economic growth is in our future as are earnings growth and stock price growth. Dow industrials (DIA), transports (IYT) and even utilities (XLU) showing a short-term spark are all headed north. Sleep well Charlie.

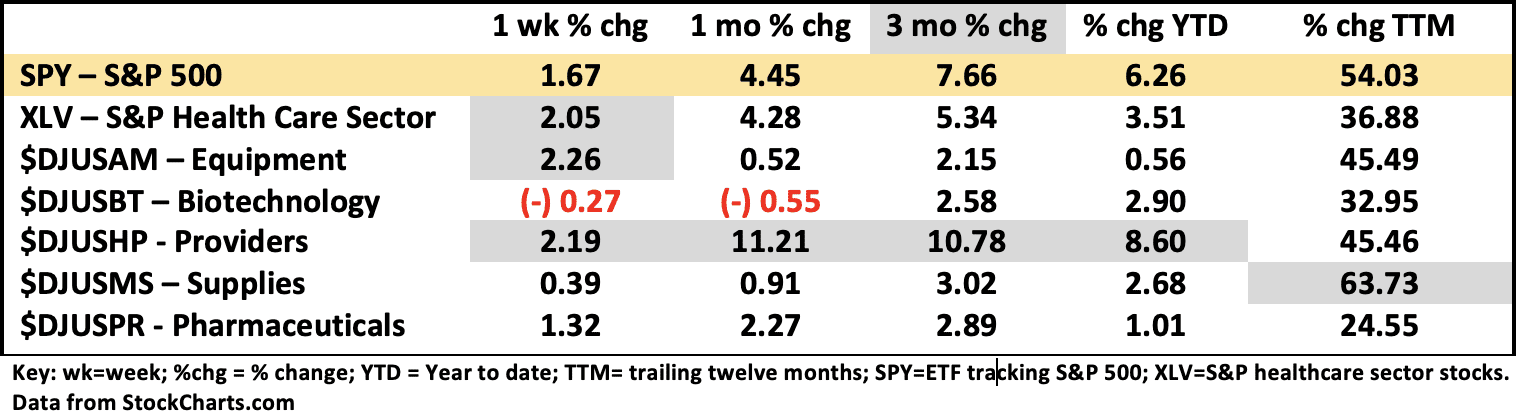

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 3/26/2021

Healthcare industry segments are becoming bifurcated. Providers ($DJUSHP) and at least for one week equipment ($DJUSAM) had good performances with providers now outpacing the S&P 500 YTD. Large cap, non-tech stocks in general are large-cap leaders this year so far. Micro-cap and small cap stocks have had a two-week correction of sorts after a 4-month recovery and massive outperformance.

Biotechs ($DJUSBT) got pummeled again last week and pharma ($DJUSPR) did its usual underperforming plod. In Barron’s this week Josh Nathan-Kazis wrote a nice column on this phenomenon and the worry in markets of a geopolitical nature. With a change in management there are concerns the FDA is slowing approvals or may change the rules of engagement. Also speed of approvals could be impacted by the number of Covid related emergency approvals pending. The FDA denies any change of this sort. But anecdotes abound.

A second factor may also be changes at FTC and FDA regarding mergers and consolidation. For quite a while now a primary exit for pre or early revenue or clinical stage biotechs has been through acquisition or merger. Making it harder would make exits longer and more difficult and likely result in more failures at the earlier stages. Big pharma uses this mechanism to reduce risk. So, they may be worth less in the future as well.

One more factor may be mergers through SPACs (special purpose acquisition companies). There is risk when a SPAC merges with a pre-revenue biopharma company. In my experience the key to success of this sort of going-public activity is revenue growth. If the biotech has no revenue good operators have a plan to use capital for acquisition of revenue or growth companies to add to the pipeline company. If there is no revenue from actual products then the only product to sell is the stock. You don’t want to be an investor when this happens. There may be some rough roads to travel as this bloom fades.

As I See It: We navigate a period of time without much firm guidance awaiting earnings and economic data. When you attend open mic sessions, consider the source. We traverse a major life, economic, and market transition. There are bound to be a lot of amateur performances.

March 29, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.