Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Looking for a Parking Place

This time of year there is a rush for parking spots for cash including cash itself before the end of year. Other than the IPO market this seems to be what we are seeing already, even though there is one more week of trading into options expiration that could provide some entertainment.

Like a train coasting uphill, last week the market’s momentum began to roll over and the speed of market ascent slowed. Contrast that to the IPO market, where DoorDash (DASH) and AirBnB (ABNB) came roaring to market. It’s still a momentum market.

The rush to tap the most massive liquidity pool ever seen supports our original thesis about stock prices in the pandemic including IPO’s and SPAC’s:

Stock prices = earnings + hope from vaccines + whole lotta money gotta go somewhere

In the cycles of most markets – this one arguably looking extreme in some cases now – there comes a point where there is more money than good ideas and sometimes more money than brains. After parking the cash, in more usual times the machines more or less take over with the skeleton holiday crew to sustain markets.

This past week the headline index results were SPY (-) 0.96%, QQQ (-) 1.20%, MDY (-) 0.19%, and IJR +0.20. Looking at the flows of cash, money market fund parking lots are filling up fast. Some money rotated back to treasuries and bonds. Unprecedented liquidity has to go somewhere. IPO’s and SPAC’s are sopping up excess liquidity now. As the old saying go, if you don’t know how money gets made (by you), don’t invest in it.

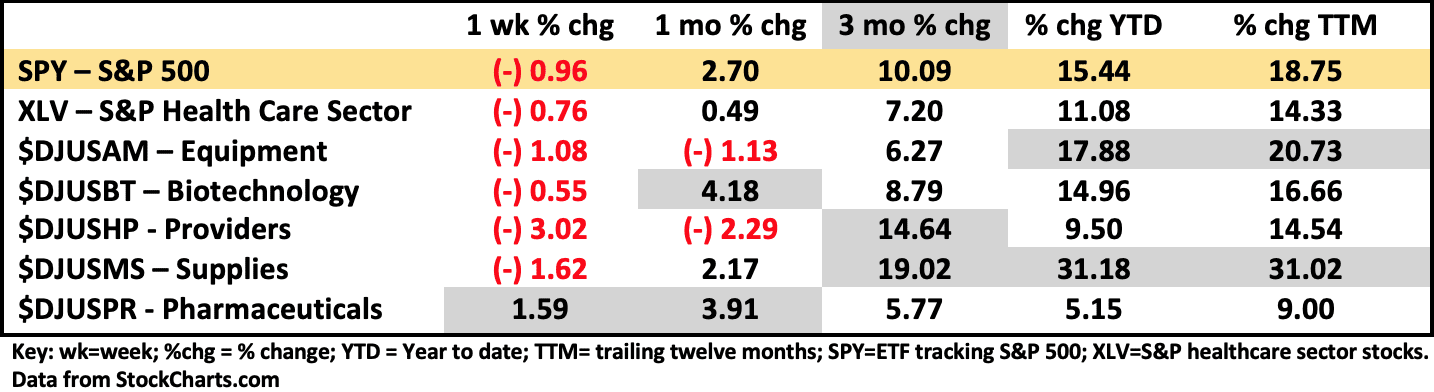

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 12/11/2020

Relative performance expressed numerically on a scorecard creates a picture of price movement dynamics similar to charts but forces us to notice quantitative change. Although short-term price changes like daily prices are interesting and even shorter intervals are interesting to quants, algos and traders, most investors understand that when a trend begins to change, the longer the change persists the more sustaining the trend is likely to become.

Pharma ($DJUSPR) is worth a watch at the moment as it has now outperformed SPY for one month after underperforming for most of the last two years. On the chart there is a nascent breakout of price pattern. Large cap pharma’s that have contributed to outperformance over the month include mostly what you would surmise from Covid-19 action: Pfizer (PFE) + 12.66%, Lilly (LLY) + 11.12, Novartis (NVS) + 7.70%, J&J (JNJ) + 4.20%. By contrast, Moderna (MRNA) is + 90.36% over a month.

Zombie companies are companies that earn enough money to continue to operate and service debt but are unable to ever pay down the owed capital. They are basically insolvent but continue to exist even though there is no money to grow. Airlines over a long part of the history are great examples.

These are not zombies, but what is a company called that raises large amounts of money based only on a story and a promise? No product. No revenue. But a possible cure for cancer. We call them Biotechs ($DJUSBT).

If you are interested in investing in one of the 70 biotech IPO’s this year, be sure to know when you may see a return. The roulette wheel is spinning.

As I See It: Momentum declined last week and with net bullish sentiment is not a great setup for further gains short term. The indexes are overbought but not excessively so and appear to be internally correcting. The peak may have coincided with the two IPO’s this week that were extreme. Next market movers: momentum + pandemic + earnings.

December 14, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.