Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Rage is all the Rage

The word itself is all the rage. The virus is raging, cutting a swath of death and destruction across the lands. Politicians are raging. Their followers are raging. In fact, at any given moment I estimate 66.71% of Americans are raging about something.

The bull market is even raging. Barron’s said so this week in Avi Salzman’s Trader’s Column: Stocks Hit New Highs as Reopening Euphoria Rages On. Can It Last?

As far as markets go this is another way of saying something like the momentum market continues. Never, never forget in such markets buy discipline is far less important than sell discipline.

Momentum markets occur when there is no fundamental reason for the velocity of the price change. Over libation we torture logic and rationalizations.

The one-month index results are remarkable with momentum becoming broader if somewhat flatter as the month wore on, meaning positive but not increasingly positive. Growth expectations are huge. Sure hope those feet grow to fit the shoes.

Over the past month: SPY is + 7.66%, QQQ is 6.49%, MDY is 13.43% and IJR is + 19.47%. Of course, this is the-first-one-now-will-later-be-last sort of stuff and indeed, the market appears to be changing in significant ways.

Momentum markets are all the rage now days. They can be tricky. Go with three-organ decision making – head, gut, heart. Know when you want to sell.

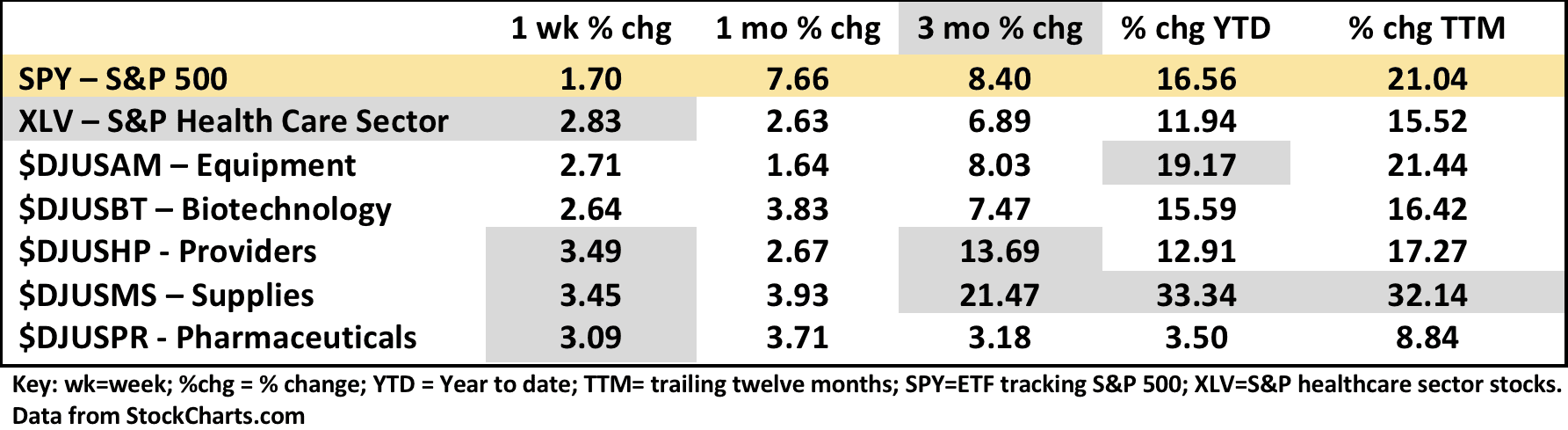

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 12/4/2020

Last week we noted that the healthcare sector ETF (XLV) had been underperforming the broader market S&P 500 (SPY) in all time frames but that momentum metrics were turning positive. And for this week anyway it outperformed SPY as did providers, supplies, and pharma. Supplies have been outperforming all year while pharma has been a distinct laggard.

One can still wonder about biotech and why we don’t see more production in these times of novel vaccines and an explosion of discovery and funding. Barron’s this week reports data from Dealogic documenting that 70 biotech IPO’s raised $19 billion as of December 4 in 2020 compared to 43 IPO’s and $4.9 billion in 2019. This large number likely doesn’t include biotech companies coming public via the SPAC route.

Ironically, the introduction of massive quantities of new stock into a market segment depresses the prices of existing companies. We will have more to say about biopharma’s that have no revenue in a later brief. Trying to track these companies is difficult. In the $DJUSBT industry sector alone there are 514 stocks which also explains why it’s hard to move the needle. The whole sector has to be in rally mode.

Another dynamic that impacts what we see on the Scorecard is the rotation in relative performance of small stocks vs. large stocks. And healthcare stocks are rapidly evolving. Where can we find tracking methods for genomic stocks or small cap stocks or digital health? The tools are evolving with the market.

As compared to the Scorecard, last week ARK Genomic Revolution ETF (ARKG) gained +12.64%. A newer ETF for digital health (EDOC) underperformed at +1.09%. The XBI equal weight biotech’s did better at +3.61% vs. 2.64% above on the Scorecard. Learning the dynamics of the market helps give a more complete picture.

As I See It: Last week was very bullish for stocks. We are reaching the tops of technical ranges but have not yet established extreme overbought conditions, which as we all know can last for long periods especially in raging momentum markets like what we have now. If “raging” was a stock it would be ripe for a correction.

December 7, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.