Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Tis the Season…

…for virus and machines. The market ground out another small gain at the headline level while continuing to seek safe harbor for the next couple weeks when machines and algos drive the markets and anybody around is either positioning or reacting. Like today.

As momentum continued to fade at the short and intermediate time frames, technology regained a bit of its former form this past week. Most of the S&P sector level charts have adopted a continuation pattern.

At the headline level results this week were SPY +1.22%, QQQ +2.72%, MDY + 2.07%, IJR +1.94. The call out is obviously QQQ. Confirmation comes from the technology ETF, XLK +3.18% and both QQQ and XLK hit new 52-week highs.

The rally remains broad in participation even if advance-decline metrics are turning more neutral. QQEW (equal weight) was +3.52% and IWM (Russell 2000) was +2.97%. The smids (small and mid-caps) outperformed again. IJR + MDY > SPY in performance in 20Q4 QTD. The catchup has been significant, but YTD SPY is still way ahead.

All the headline indexes hit new 52-week highs last week: DIA, IJR, MDY, QQQ, SPY while only two sector level ETF’s accomplished this result: XLK (tech) and XLY (discretionary). The market remains in a bullish stance, wary of a correction and slowing down for the end of year finishing touches assuming no new disasters.

I’m ready to let the machines have it for a while. Adios 2020. See you in 2021. I keep one eye open.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

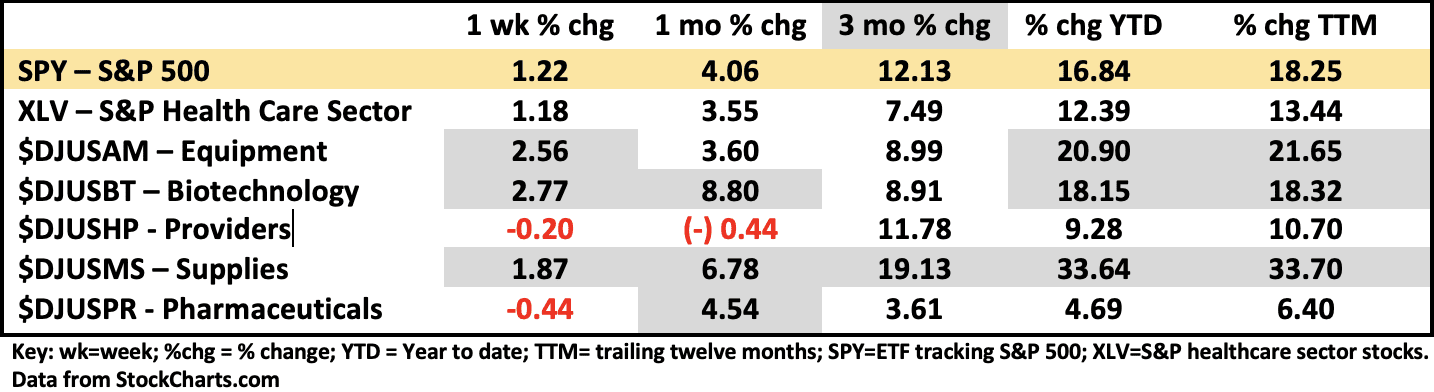

Healthcare Segment Scorecard - as of close of market 12/18/2020

The healthcare sector ETF (XLV) has underperformed SPY for a year now. That seems interesting given where we are in the throes of pandemic. What is not too surprising is that the leadership group is Supplies ($DJUSMS) that in contrast has outperformed in the TTM and every interval along the way. Top performers by size YTD are Align Technology (ALGN) +90% (large cap), Natera (NTRA) +202% (mid cap), and Retractable Tech (RVP) +657% (small cap). In some ways the current distribution of performance seems explainable in the circumstances.

Pharma ($DJUSPR) rallied for one month and resumed its position as the healthcare caboose. Large cap stocks in pharma (e.g., MRK) and devices (e.g., MDT) struggle to outperform SPY. Outperformance is found in smaller firms in both equipment ($DJUSAM) and biotech ($DJUSBT). As investments the large stocks basically function like bonds with good dividends but low if any price growth outperformance.

They are portfolio companies that have to manage the product life cycle of literally hundreds of products all of which are in different phases of their life cycles. Few do it well consistently. On the other hand, they don’t go far south very often except when subject to IP and regulatory risk.

Even Pfizer (PFE) in the thick of the vaccine sweepstakes underperforms SPY and has undergone significant stock distribution (i.e., selling) even while the price spiked on recent news, that is, holders sold into the rally.

To understand these markets better two elements to examine are consistent outperformance that also has a long technology development runway. This is not big pharma and big device for the most part.

As I See It: Activity is slowing down and continuation patterns proliferate. NDX is more bullish than SPX. SPX sectors are sideways to mild correction except XLK, XLY +/- XLV. It’s time to let 2020 be – sans a new disaster. Enjoy the season and come back to it in 2021.

December 21, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.