Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Waste Capital

Old saying: entrepreneurs succeed by wasting what is abundant to conserve what is scarce. Waste capital. It is abundant.

In a time of recurrent rotations, we did what we always do and checked out if an old trade still works. We went big-cap tech last week. The indexes (SPY, QQQ, MDY, IWM, DIA) hit new highs.

A peak under the headlines shows the US equities more broadly demonstrated slowing momentum and significantly mixed performance. The weakening momentum evident for some time extended into the intermediate time frame where price momentum ‘buy’ signals fell below 50% of issues on SPX.

The S&P sector strength likewise returned to a tech basis. Hitting 52-week highs last week included technology (XLK), discretionary (XLY – digital retail and home builders), healthcare (XLV – biotech) and communications (XLC – internet stocks).

The constant debate at the moment is about liquidity and the impact of taking on another $1.9T of debt by the government along with the Fed’s many liquidity programs. While we have all this cash availability, we should waste as much as we can before the consequence pile up. And we are. The number of companies going public by IPO, direct listing, SPACs and reverse mergers is large and growing. While some worry about froth, I am cheering.

The more companies who make the leap to public markets, the better long term for the economy. We have time and resources to waste on stuff that won’t work. It’s how we learn. It’s how progress happens. Let’s take advantage of it. And may you always stay on the right side of the trade.

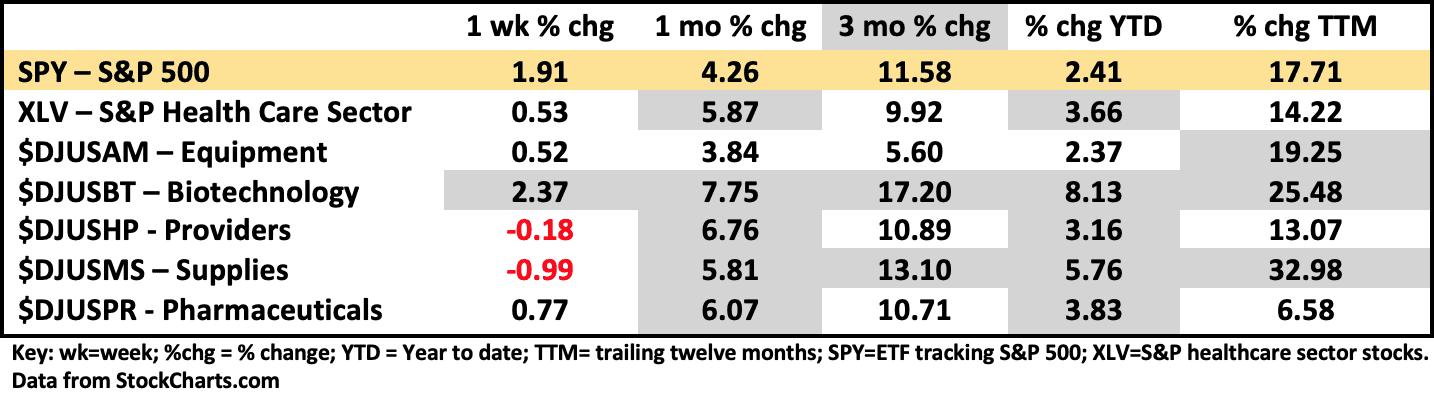

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 1/22/2021

In keeping with the tech rally of this past week, most of the healthcare (XLV) complex underperformed. Only biotechnology outperformed SPY. This has now extended to the intermediate time frame (3-month) and TTM long term. Given the current circumstances, vaccines, antivirals, genomics, oncology treatments and all the rest, this seems to make sense. Which always makes one wonder.

We at least have to ask the question is this a Whoosh trade or something more sustained? XBI and IBB the two dominant ETF’s covering the biotech sector ($DJUSBT) have rallied since the March 2020 lows. Not in a straight line but consistently. XBI has been the stronger of the two and is +149% off the 52-week low from last March. XBI is +8.4% TYD vs. +2.41% for SPY.

Even more telling is the net accumulation of biotech stocks which has been more or less continuous over the past four years. It is reasonable to conclude that biotech is one of the technologies that like others such as software, semiconductors, cloud, and cybersecurity are part of tomorrow’s technology ecosystem and thus sustainable investments. The thing to recall about biotech companies is there are a huge number of biotech stocks that came public with no revenue, just a story, a prayer and a promise. The only thing they have to sell is a stock. Know your buy and your sell discipline.

The top performer last week in $DJUSBT was Gritstone Oncology, Inc. (GRTS) that gained +324% in one week. Even before last week’s news, this company had revenue since 2018. A little. With a lotta loss. Positive signs included increasing free cash flow over the prior three quarters. What’s the story? Gritstone announced last week advancement of SARS-CoV-2 vaccine with a potential to protect against mutant variants and supported by NIAID and Gates Foundation. Boom!

As I See It: US equities hit new highs on most of the indexes. Upward momentum is waning and the internal market dynamics are corrective in nature. Biotechnology firms are part of the tech complex and investable.

January 25, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.