Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

The Product Called Healthcare

If a market exists called healthcare, then there must be a product called healthcare. Stretch your brain and define the product in a way where a $4 Trillion annual public investment can at least be categorized.

Here is a suggestion:

The Healthcare Product is a biotechnology-based, information depended personal service.

Rationale: Beginning after the Flexner report of 1910, US medical education and practice began to adhere to the scientific model of medicine to the exclusion of other schools of medicine. Subsequently, massive and increasing investment has been made in the biotechnology complex (basic research to care delivery) leading to the scientific basis of medical care as we now know it. I have left off the other schools because the vehicle to invest in them is unknown.

The information dependence aspect of the healthcare product is defined by the need to deliver to the point of service specialized knowledge and specialized skills in order to deliver medical care. We have invested heavily in this area over the last hundred years. The traditional way to deliver specialized knowledge and skill has been through highly trained and licensed people, physicians and other caregivers.

As the amount of knowledge to treat patients increased exponentially in the 20th century automation of information delivery to the point of care became necessary, as even an army of specialists can fail to meet the service requirements of some patients and the lack of standardization and coordination of care is harmful.

There has been great resistance to the bedside automation and integration of physiologic and human data much less to individuals outside the control of hospitals and physicians and for a long time there was significant underinvestment and under development in this area.

This is changing starting with EHR’s and is now called digital health with process and analytic automation making complex care available anywhere. Despite we are in early days of proving efficacy much less effectiveness of digital health solutions, the amount of investment is growing large and fast. The bet is on.

Finally, the product of healthcare in its last step is a delivery of a personal service. The person receiving the care receives it as an individual either as self-care or as one individual delivering service to another. We have traditionally invested least in this area and patient and consumer experience in healthcare has a dismal history. But herein is the opportunity.

Catching up to digital health, consumer health is finally showing a high level of activity and is attracting large investment. The ultimate value of these tools for consumer health and for improving clinical outcomes at this point remains an assumption. It’s new to us. Expect trial and error.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

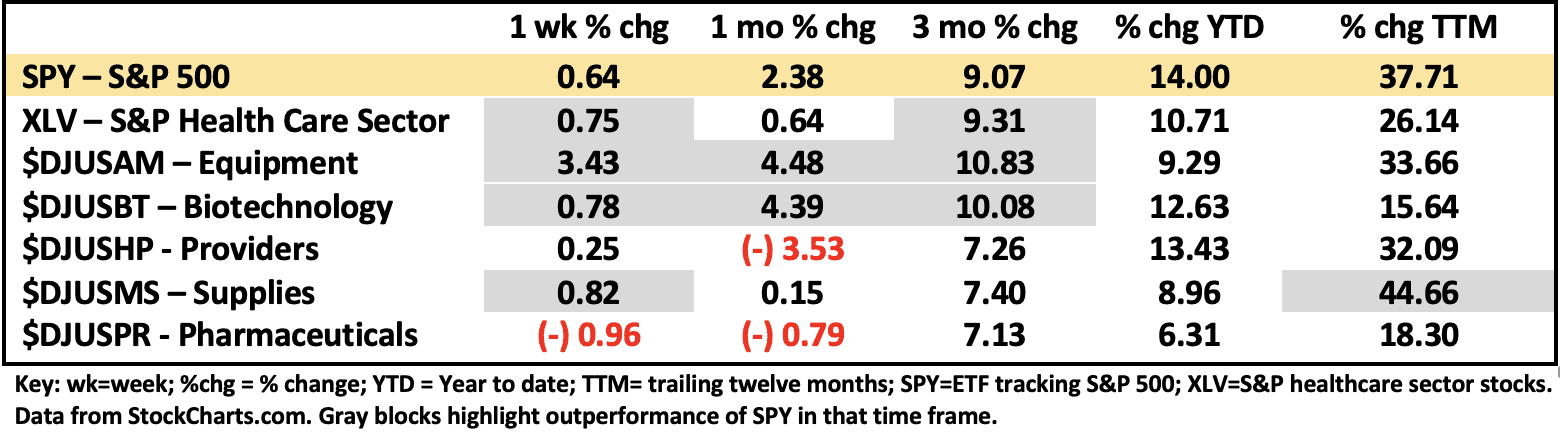

Healthcare Segment Scorecard - as of close of market 6/23/2021

Investment and customer consumption of the healthcare product is large and growing fastest in the areas of biopharma and medical devices. Medical interventions represented by these two areas are part of our future evolution of cures, treatments, and bio-enhancements along with genomics and the other omics which are likely to have their market expression through these two industry segments as well.

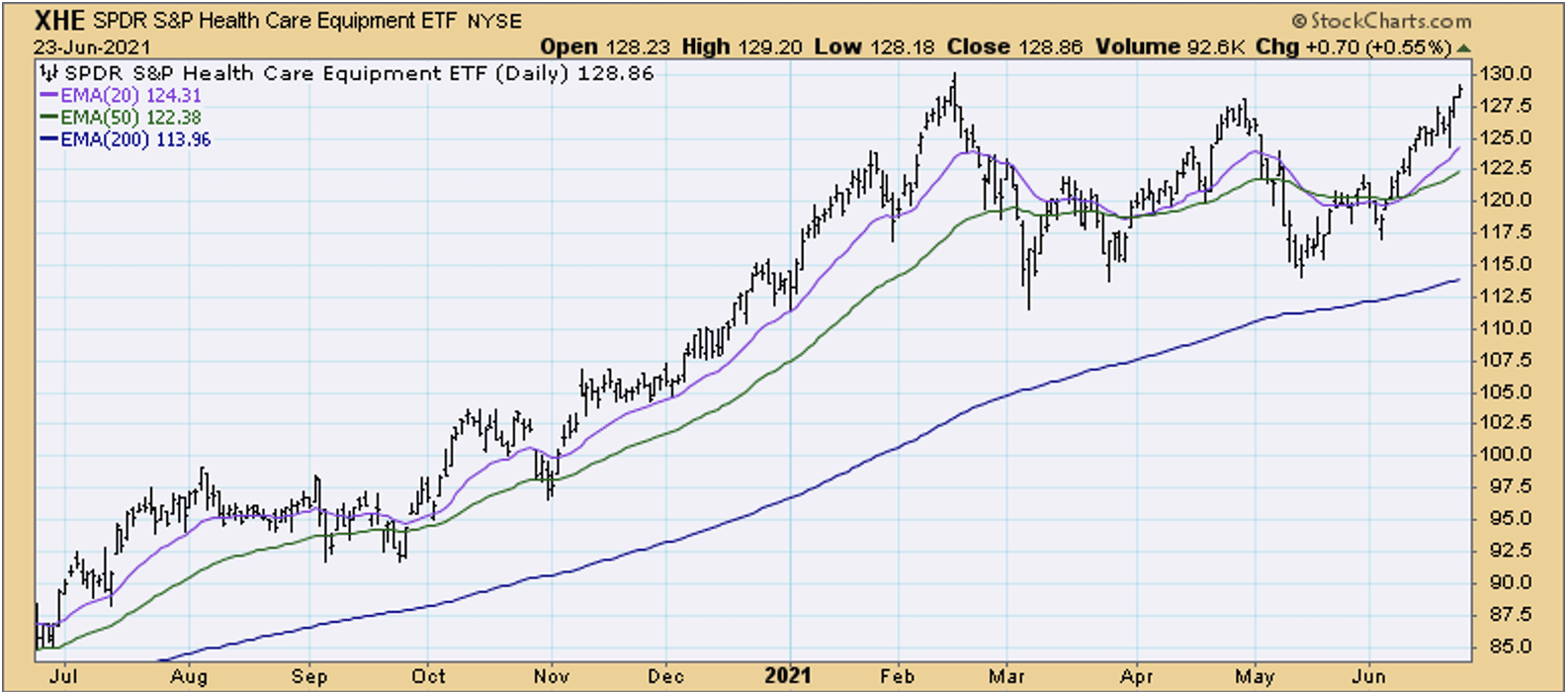

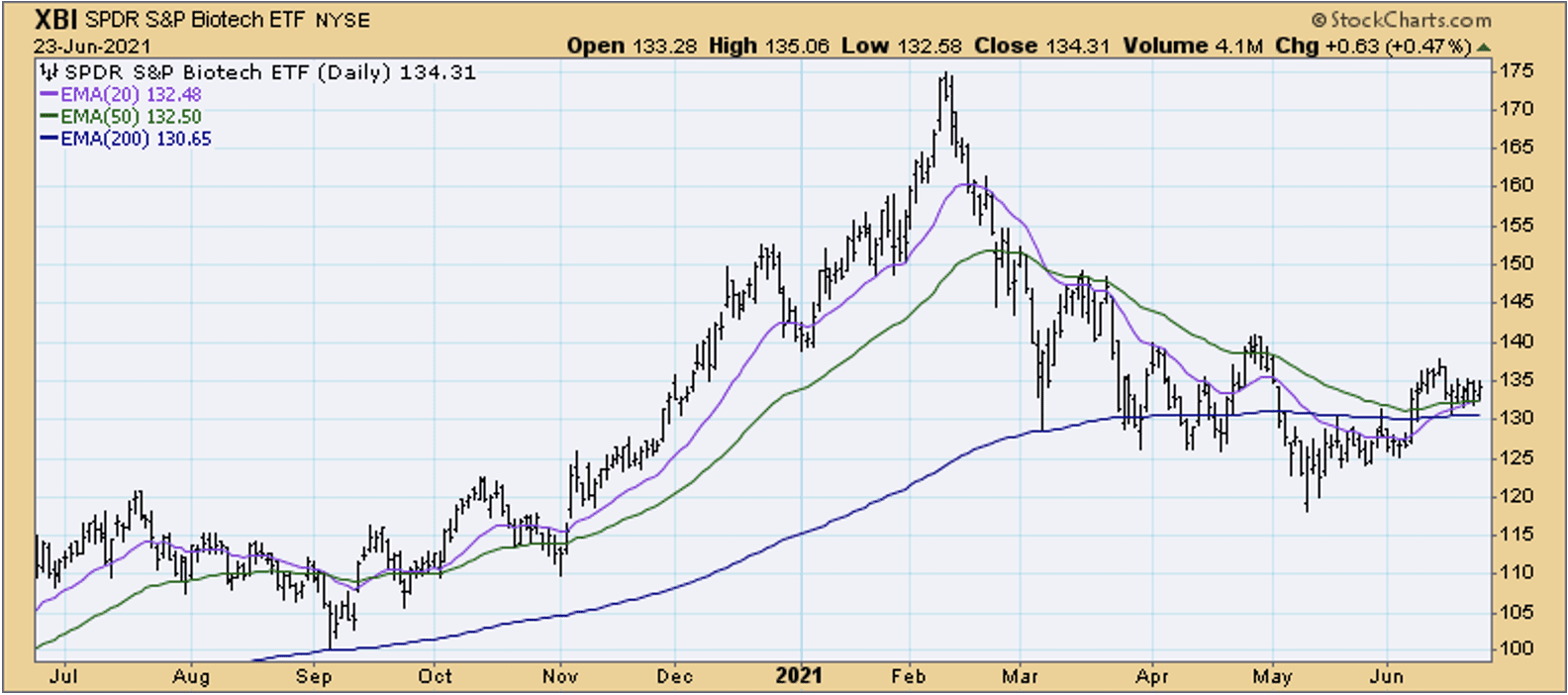

It makes sense to follow this evolution through growth and valuation of stocks in these industry segments. One way to do so is to follow exchange traded funds (ETFs) that contain these stocks. Two common ones are the XBI (biotech) and the XHE (medical devices) ETFs. XBI tends to be more volatile.

Both equipment ($DJUSAM) and biotech ($DJUSBT) have been outperforming SPY over the intermediate time frame (3-month). Both XBI and XHE had significant corrections after the February highs, though the correction is more pronounced and prolonged with XBI (biotech). XHE (equipment) has sustained a stronger rally from the May low which supports the event of a more usual level of healthcare utilization resuming post-vaccine.

As I See It: Organizing healthcare products and services into three categories including biotech complex, information dependent services, and consumer and patient experience and self-care may help track performance and relative valuation. In the end, whether new tech brings clinical value is the open question.

June 24, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.