Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Digital Health Abundance

Humans seem to waste that which exists in abundance. We have had investment capital in never-before-seen amounts. And significant investment has been made in digital health, accelerated by the Covid-19 pandemic.

All of this raises the questions: of the $14 billion of investment in 2020 in digital health and the additional $7 billion or so to date in 2021 (Pitchbook), how many digital health products or services will be either financially or clinically successful? How many are useful? How is value created for patients or consumers?

Is telehealth, for example, a wave that recedes to be followed by a smaller wave? Or is it a flood that claims the land and never recedes? The former seems more likely than the latter.

This implies rapid evolution of virtual care services to rapidly adapt to new delivery systems and to invade new niches of care management like chronic condition management, diabetes care, and care coordination which is ever dependent on traditional workflows, means of access, and payment methods. Do digital health solutions bring value in the ways that support the cost of change at this level? Do they change clinical outcomes or behaviors?

They are largely unproven so far. As noted by Perakslis and Ginsburg in JAMA in December 2020: “Digital health has potential to improve health management, but the current state of technology development and deployment requires a “buyer beware “cautionary note.” Clearly, we have made progress in digitization of healthcare, but have we just rolled over the peak of inflated expectations on a Gartner hype cycle curve?

Rolfe Windler writing in the Wall Street Journal in May 2021 opens with, “Digital-health startups have boomed during the pandemic, raising record amounts of capital for a range of services. The message from some of their customers: Enough, already.” We can use smaller sensors and mobile apps to gather ever larger amounts of data. But the basic question, “So what?” has yet to be answered. Better care? Greater convenience? Both? Neither? Amazingly, it’s still early days. The approaches are not new necessarily even if the tech is. Will the outcomes be different this time?

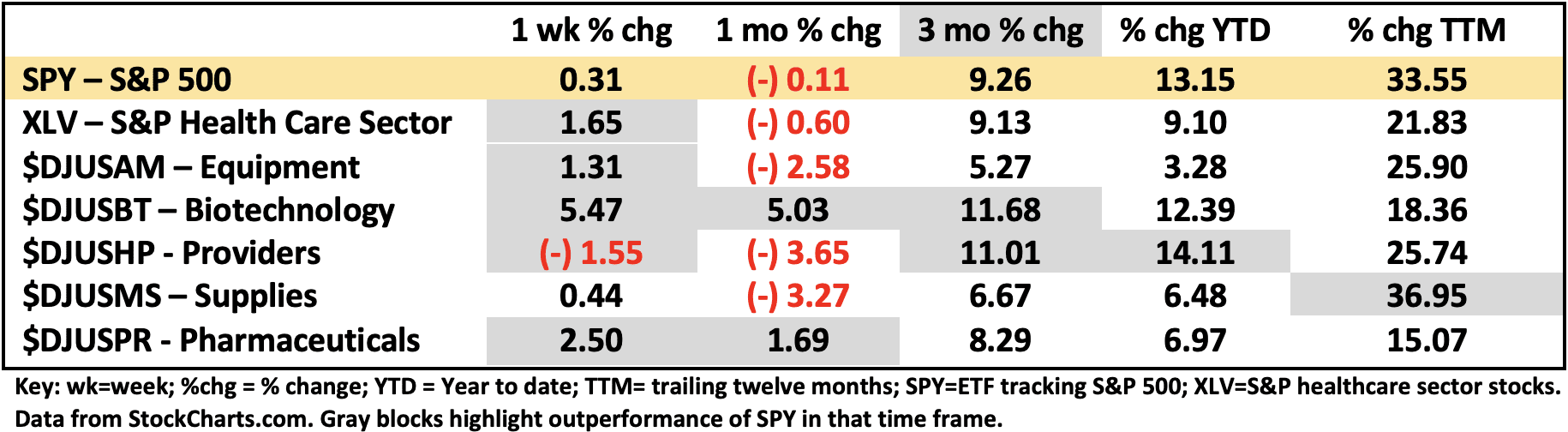

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 6/9/2021

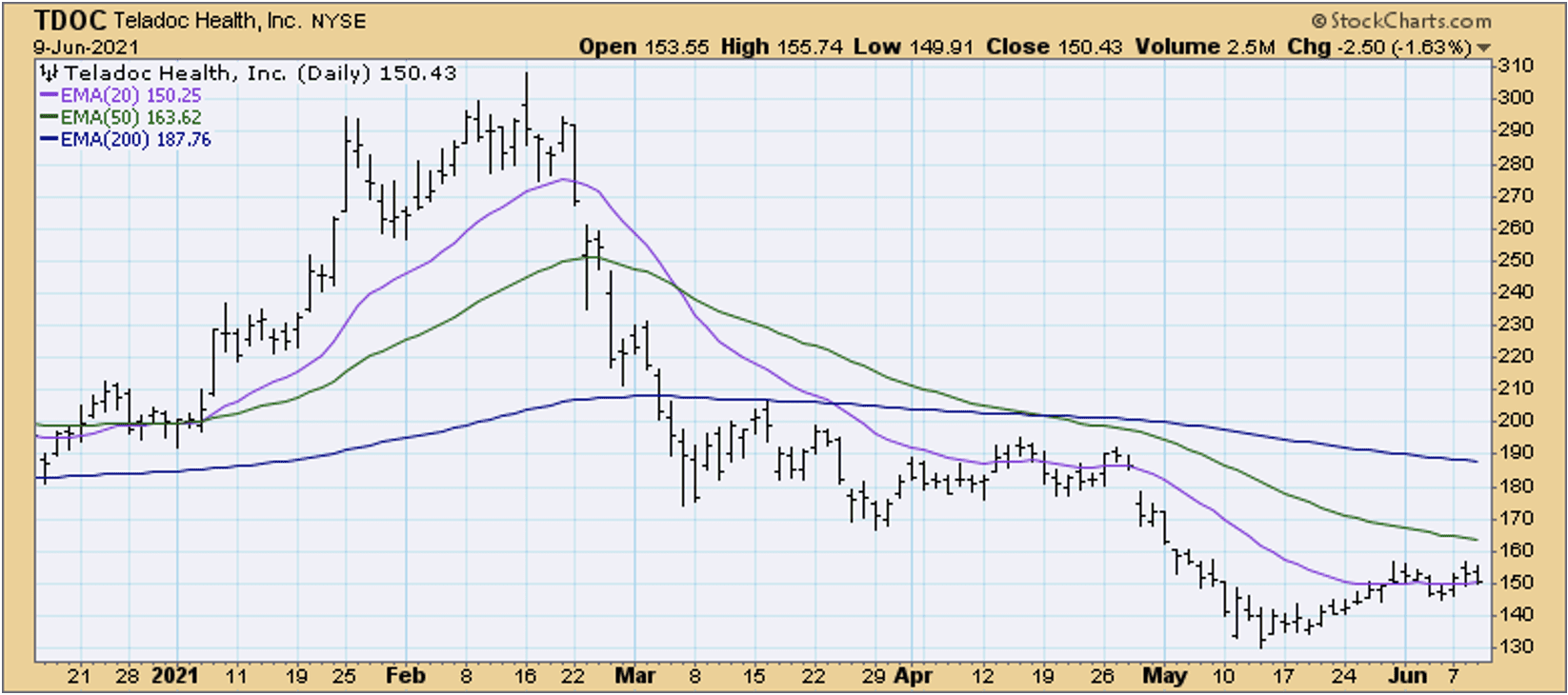

One way to assess how the market values digital health and to determine the near-term future expectations is to examine digital health stock performance. During the pandemic while some digital health companies were growing rapidly like Teladoc (TDOC) the prices grew rapidly. In 2021 when the prospects of either flat growth or contraction appeared, the prices fell. Digital health became part of the post-vaccine reopening story in a negative way. TDOC stock is (-) 25% YTD (see chart). This is in the context of underperformance of healthcare stocks in general as well as a correction in technology and software stocks.

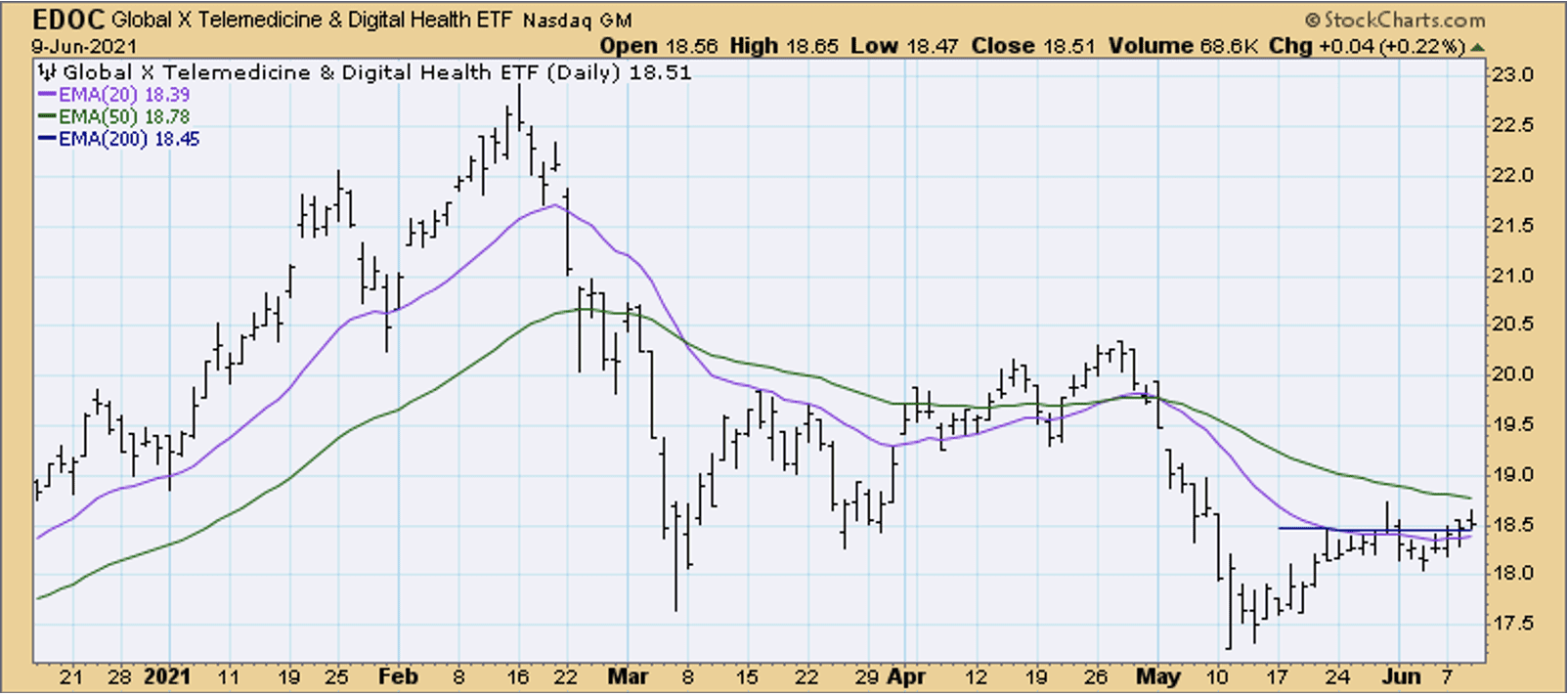

Note that in the traditional healthcare sectors there is nothing called digital health. In fact, most of digital health companies are classified as software and thus in the technology sectors. An ETF seeking to track telemedicine and digital health (EDOC) came to market about eleven months ago. There are 40 stocks in the ETF many of which are neither telemedicine nor digital health in the narrow sense but often deliver their product through software. There aren’t that many publicly traded digital health companies. For all the hype around VC activity, the public markets have not been that enthusiastic. EDOC is (-) 4% YTD. (see chart)

Looking ahead performance of digital health in the public markets will likely be driven by sustained growth which for a time may well come from taking market share from competitors and from acquisition. There is a huge number of private digital health companies some of which will do well and are likely to scooped up in a wave of consolidation or eventually go public. Most will not survive as independent stand-alone firms.

As I See It: Digital health has been setting records for raising money in the private markets through VC’s and other sources of private investment. The hype is enormous for unproven technologies. The dynamics in the public markets for digital health stocks, the few that exist, hasn’t been so consistently enthusiastic. This will sort itself out based on delivering of actual value to patients, consumers and shareholders.

June 9, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.