Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Driving the Current bull

The US equities, despite the Age of Covid and its impact on some sectors of the economy, are in an unabashed bull run. What gives?

The price of a stock under common circumstances is determined by market buyers and sellers and their beliefs about current earnings growing in the future. The metrics and ratios used to project future earnings are often used to determine valuation.

We are in anything but a common circumstance now. Since Covid we have learned companies fall mainly into one of three categories: thrive and hyper-thrive; get damaged but find a way back to thrive; get damaged and don’t come back at least as they were.

There are stocks now in the “hyper-thrive” category whose prices have no basis in common valuation. So what drives the stock price? In this case, three things: earnings + hope + whole lotta money gotta go somewhere. Earnings and assumptions about growth in the current environment drive price. Hope that treatments and a vaccine come soon drive interest in the so-called reopening stocks. And the Federal Reserve +/- Congress have provided the largest pile of liquidity these markets have ever seen which builds a sort of floor for prices.

When usual valuation methodologies no longer provide rationale for the market, what does? Momentum. This bull run is largely a momentum market. Money in motion. It’s a vector function of velocity and direction. Momentum markets are untethered from actual occurrences and are always story markets. More begets more. Until it doesn’t.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

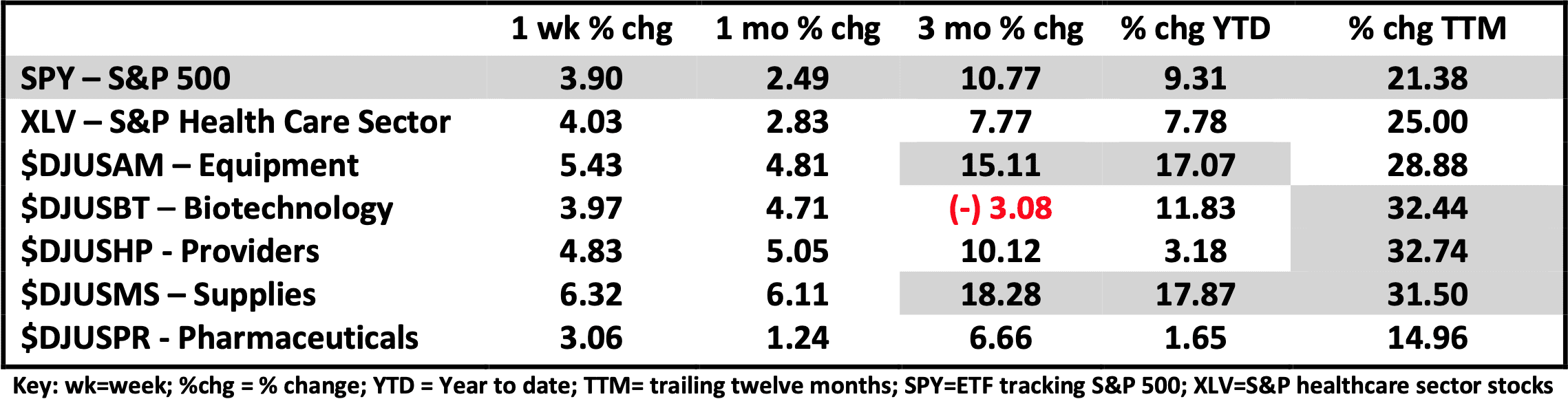

Healthcare Segment Scorecard - as of close of market 10/9/2020

The broad US stock market as represented by the S&P 500 (SPY) has been ripping higher for a couple of weeks and gained 3.9% last week after a little correction in September.

XLV, the S&P healthcare sector, has year to date underperformed SPY. Looking at the scorecard, the lesson is that not all subsectors have underperformed. Two, medical equipment and supplies, have outperformed SPY and would be a place to look for momentum related opportunities in this type of market.

Another way to think about relative performance and relative momentum is to examine performance over time compared to SPY. In this type of analysis, XLV has underperformed everything but energy (XLE) in the intermediate time frame (10-12 weeks) when these two factors are taken together.

Looking over the same time frame at the subsectors listed above on the Scorecard, only Medical Supplies has shown relative strength and momentum compared to SPY.

This is why we look at the actual results and movement over time. If we simply listen to the noise and the hype we see/hear on various media, we would think healthcare should be outperforming across the board. But the story isn’t all that clear. It’s mixed. And this is a story market driven by momentum.

As I See It: The healthcare part of the market has been flat and largely performing either “at market” or underperforming. Of course, there are individual stocks that are exceptions. Despite demand for critical services and Covid related products and services, some parts of healthcare have fared less well. Next time we’ll look in more detail digital health and some changes there. Can the “new healthcare” persist?

What comes next?

October 13, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.