Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Our intent is to educate you in useful ways of thinking about the public healthcare markets including the explosion in 2020 of healthcare IPO’s and digital health, devices, diagnostics and therapeutics along with other technologies and innovations in healthcare payment and delivery.

Drifting Toward an Election

As the markets get closer to elections, they tend to drift unless there is new news. The current pattern on the big- cap indexes (e.g., SPY) of a double top with the September highs along with contracting volumes and falling but sustained momentum is a little ugly.

Many market players don’t see a lot of reason to move in these circumstances. In fact, despite a little downsy-upsy this past month, the stocks haven’t made much significant change from the first of September highs. We call that euphemistically “increased volatility”.

As we have been for a time, the market is at a decision point and marking time. This is what passes for procrastination in markets. There are some notable cautionary historical trends: like October’s history of crashes and election trends.

We are now in the pandemic market. What has been working in market should continue to work for a bit longer. I would say the only real exception I see is industrials (XLI) which has outperformed over 3 months at +14.5% vs. SPY +8.7% and tech (XLK) at +14.2%. Consumer stocks (XLY, XLP) deserve a follow.

Perhaps the other one to watch is healthcare (XLV). It had a good day on Friday and has been more or less performing “at market” or a little worse most of the year, which is typical of presidential election years, healthcare being a government-regulated utility. The fact that the providers did well last weeks is a good sign that somebody may be looking ahead of the election outcome.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

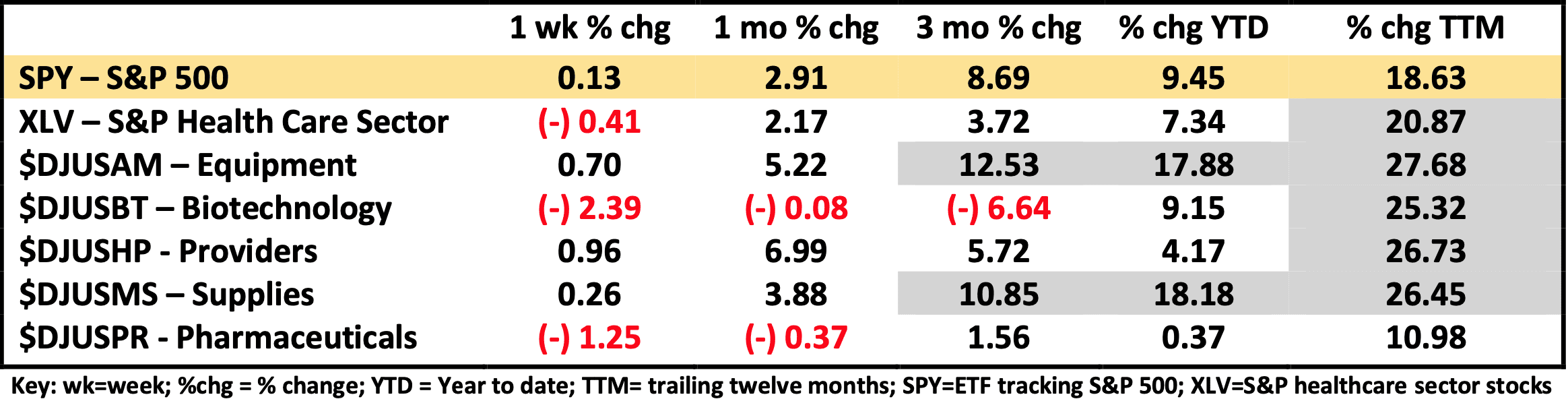

Healthcare Segment Scorecard - as of close of market 10/16/2020

The scorecard is organized to show the relative price performance of the broadest relevant market industry segments of healthcare. The Dow Jones ($DJUS__) industry segments are used because they focus on stocks traded on US exchanges regardless of size or style in this case. Areas of outperformance vs. SPY are shaded.

These may differ from ETF’s (exchange traded funds) that may be familiar. For example, medical devices which are included in DJUSAM-Equipment, may also be seen in ETF’s like IHI (iShares US Medical Devices) that tracks those device companies contained in the broader DJUSAM. IHI has 65 stocks in its ETF while DJUSAM has 158 stocks to illustrate one difference. YTD IHI has gained +19.0% vs. +17.9 for DJUSAM.

What if you want to understand how newer segments of the market are tracking, like digital health or some of the Covid-related therapeutic companies? Rock Health https://rockhealth.com follows 33 digital health companies and publishes data on earnings and other updates. There are a few older companies (e.g., CERN) there but many of the more recent successful entries to the public market (e.g., TDOC) on the list.

There have been a large number of healthcare companies go public this year. Most have been in the biopharma arena and are likely one reason that biotech (DJUSBT) has been underperforming. Loads of new stocks depress the price of the existing companies in that market segment. There have been so many that in order to make sense and keep track it is recommended to choose the ones that may interest you from a business perspective.

As I See It: In election years healthcare (XLV) tends to perform slightly worse than the overall market (SPY) one supposes because of the political nature of the US healthcare system that creates elevated policy uncertainty. One can argue this year that this effect is more acute and pronounced than many other election years. Equipment has outperformed for many months. Along with supplies these are the places to be unless you happened to get a ticket on one of the 2020 IPO’s (e.g. KYMR or LUNG). And remember many health tech companies are listed as software companies (e.g., VCRA, TDOC, LVGO). Stay tuned for November, however, XLV usually performs well in November, regardless of outcomes, so long as there is one.

October 20, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.