Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

The Market Beast

The US equities last week despite minor negative results on the major indexes (e.g., SPY, QQQ) showed positive positioning below the headlines. Sometimes it is helpful to look at its more minor aspects to get the market’s full message. And then, there’s the new surge of virus.

It is well to recall that the two biggest sectors comprising the S&P 500 are technology (XLK 28%) and healthcare (XLV 14%). Both XLK and XLV have underperformed SPY for the past month and XLV has underperformed much longer, for the last five months.

Stocks that are not-SPY and not large stocks have done better over the past month. It is encouraging to see that other areas of the market may be starting to participate.

E.g., the S&P 600 small cap gained +13.6% over the month and the S&P 400 mid-cap gained 12.7% vs. SPY at +7.17%. If this trend persists it will help the overall market performance as we advance into the recovery from Covid. But we may have challenges before that.

How can we think about the Market Beast? The stock market is perhaps the longest continuously running data set documenting mass human behavior in real time. Using models based on standard financial metrics we can use past patterns to predict future behavior of stock prices, so-called fundamental analysis or what we believe should happen. Or we can use technical analysis of the charts, a recording of the daily price change. It is a record of what actually happens even if we don’t know why. Big data. We seek insights.

We should all learn to use both tools sets. Neither is better. Approach the market with your toolbox loaded.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

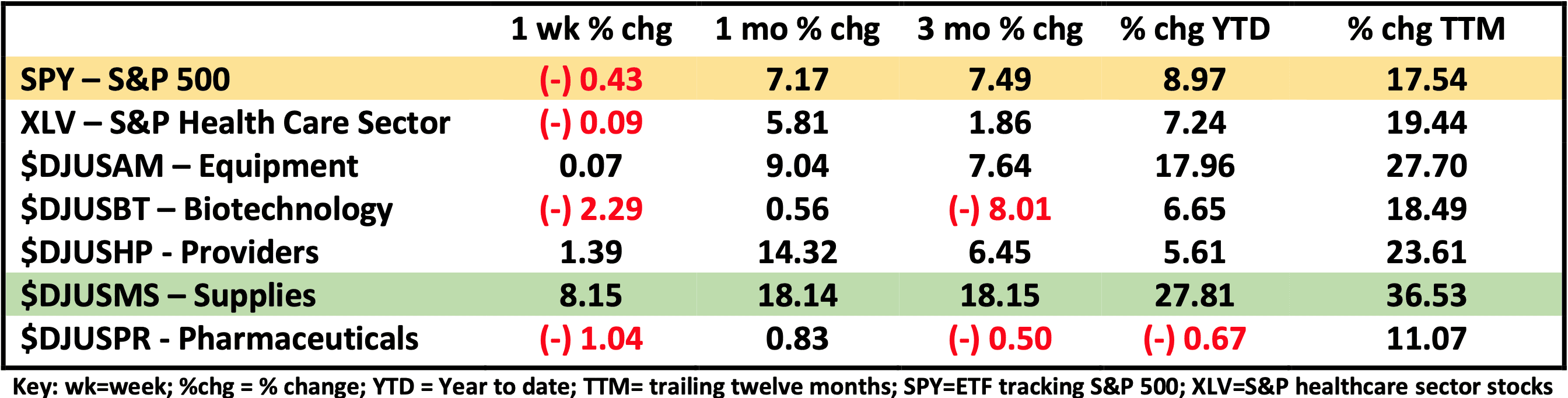

Healthcare Segment Scorecard - as of close of market 10/23/2020

The healthcare sector of the S&P 500 (XLV) continues to underperform the broader market (SPY) year to date. Despite that over the last month medical equipment and providers have had a moment, the area of healthcare results we should examine is medical supplies ($DJUSMS). This industry segment of healthcare has outperformed this year and not biotech or pharma, despite the mindshare these get. Who are some of these firms, the ones that have been leading their market niche?

Some examples of companies classified as medical supplies that have contributed to the outperformance of this segment include large stocks like West Pharmaceutical Services (WST) providing proprietary packing and +88% YTD. DexCom (DXCM) providing diabetes testing solutions and +88% YTD. Align Technologies (ALGN) supplying orthodontic products and +68% YTD.

In the middle-sized firms contributing to the outperformance are such firms as Quidel Corp (QDEL) providing testing solutions and +231% YTD, Natera (NTRA) providing genetic testing services and +111% YTD and a micro firm Retractable Technologies (RVP) providing safety medical products and +474% YTD.

Based on the news flow it’s not clear you would ever hear of these firms. Their products don’t necessarily make headlines outside of their industry and yet they make healthcare delivery possible. Healthcare of course is a huge market. The explosion of technology is suddenly being rapidly accepted and consumed by the market in every segment. Even if you aren’t in the most talked-about market segments, there is plenty of opportunity throughout the XLV. And it’s not always in names you may know or have heard of.

As I See It: The overall markets this past week despite the headlines signaled some bullish messages beneath the headlines. And yet we have virus surge again. We look for continuation of some of these into longer trends as we traverse the recovery though clearly we have a challenging time ahead of us this fall into winter with the virus. Supplies and equipment are already market-recognized to help meet the challenge. Next up, a look at the vaccine companies. It’s very noisy and political, but we should try to understand what’s coming.

October 26, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.