Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Holiday Bull

The holiday spirit hit the markets last week. Definitely a bull and not a turkey. S&P 500 did its part up +2.35% but was outscored by most other indexes.

As has been the case recently small cap stocks won the index week with S&P Small Cap 600 (IJR) at +3.83% and hitting a new all-time high, finally exceeding the August 2018 high. And to continue the broadening of the market story, RSP (equal weight S&P 500 index) outperformed SPY over one month with RSP +12.76% and SPY +7.52%.

Over the month of November there is a healthy, bullish pattern that is now persisting in time. There are multiple likely potential contributors to this outcome:

- November seasonality

- Earnings better than expected

- The virus v. no virus story

- Liquidity with us for now

- Relative performance of equities

Overall, the economic indicators are none too rosy short term as the pandemic rages and does its damage. The market moves are not closely correlated with much of anything actual. The rationalizations and logic are tortured at best. That means we remain primarily in a momentum market. The broadening of market participation continues. As we traverse the pandemic we recalibrate in new areas based on future hopes and projection of best-case scenarios.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

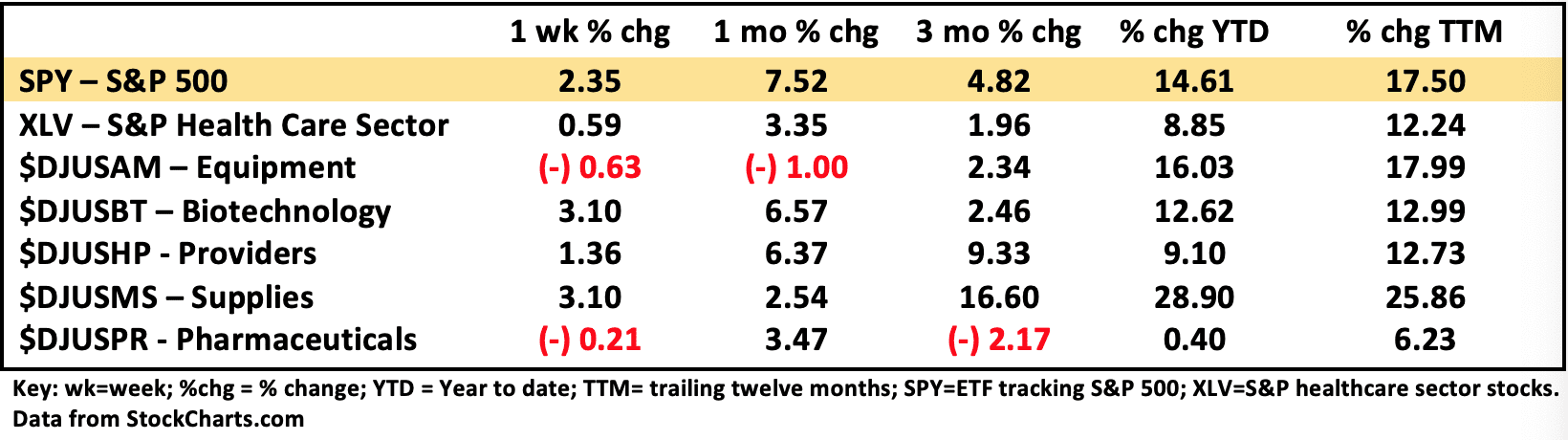

Healthcare Segment Scorecard - as of close of market 11/27/2020

The healthcare sector ETF (XLV) continues to underperform the broader market S&P 500 (SPY) in all time frames. The dynamics within the sector show supplies (DJUSMS) outperformed in nearly all timeframes, while equipment (DJUSAM) is a good example of early year outperformance and then losing steam. Everything else is middling except big pharma (DJUSPR) which is a true laggard.

We continue to be interested in the groupings found in other ETF’s like XBI (biotech) that gained +4.30% last week and is +38.4% YTD vs. 12.6% for DJUSBT. A similar dynamic is found in XHE (medical devices).

It begs the question about the nature of the healthcare market. The member companies comprise the second largest portion of the S&P 500. It is an incredibly diverse group of industries. Depending on your investment objectives you can find blazing growth or slow at-market performance with high dividend yields. Sometimes they are called defensive stocks and sometimes growth and sometimes value. Throw away this sort of classification. It’s not helpful.

Healthcare per se functions in a highly regulated government utility model with a fringe of big money entrepreneurism. Do we have a healthcare system in the US? If we did, we would have a system designed to deliver health. We don’t have that.

To understand healthcare it must be considered a political system first. And whether you like the terminology or not, it is by nature a redistributive system, as not everyone consumes the same amount of healthcare in a year. The fundamental flaws in our ability to deliver health derive from our unique and bizarre system of payments. This underlying nature of the beast also impacts the dynamics seen in the healthcare equites.

As I See It: Although it is difficult to make very strong conclusions on a holiday week the market remains very bullish and became more so last week. The healthcare sector has been mildly correcting for a while and underperforming the broader market. Technicals suggest this may change soon. Stay tuned.

November 30, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.