Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

The Cake is Baking

Macro and micro velocity trends were the game last week. While the market macro was negative and momentum turned negative on indexes, at the micro level of individual issues, the lessons of momentum couldn’t be ignored. The cake is in the oven.

Last week’s performance of SPY (-) 3.35% took away SPY gains YTD (-) 1.02% and chopped market index gains almost completely for the year except for SMIDs (IJR +6.17%, MDY +1.44%) and in sum re-positioned index momentum downward

A new source of free money – squeeze the shorts – played out last week in the GameStop (GME) incident. One more or less concludes that human nature doesn’t change but the ways in which human nature can be leveraged may. This seems a good example, as if we needed more at the moment, of technology amplification.

It struck me as supreme cosmic irony that the name of the stock that served as the proband of this market evolution is called GameStop (GME). As there is no stopping this game. Clearly gamification has come to stock trading broadly. It was already there but adding an online, real-time predator-prey game that caught the prey sleeping and used real money was probably foreordained.

The recipe for this cake was pure cosmic flow – the juxtaposition in time and space of people and events unknowable and uncontrollable. We mixed unprecedented debt driven liquidity + infinite instant network communication + free trades + fractional shares + identification of a fat target + ease of access to all trading methods + no prior experience of many of the initial players to muck up experimentation. Voila! A tasty concoction that is now baking.

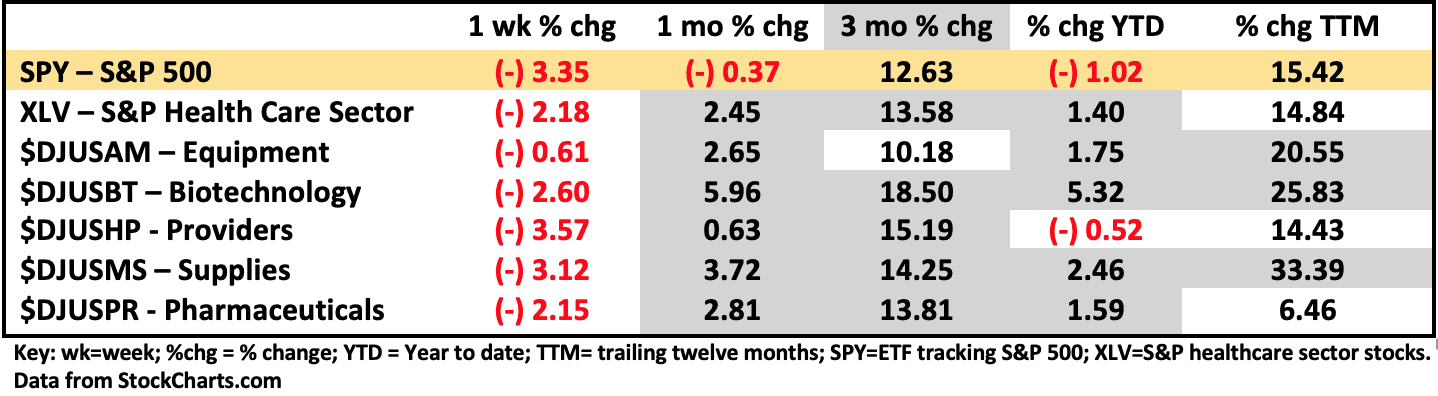

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 1/29/2021

Something new in recent times, a broadly down week. Significantly so. The nature of the S&P healthcare sector (XLV) is to perform at market or a little less in bullish movements and a little better during down price movement. This is well illustrated in the scorecard where XLV outperformed SPY this week (less negative) but lags SPY during the long bullish move over the last twelve months.

Looking at seasonality over the last five years, six months of the year XLV performs at market, i.e. equal to SPY. Three months better and three months worse. It is its nature. It is why some classify healthcare stocks as both “growth” and “defensive”, a classification not of much use.

Part of the reason for this behavior is due the large low volatility and slow growth large pharma and large equipment firms. Last week had an exception.

Abbott Labs (ABT) revenue was up +29% and EPS was up YoY +53%. The jump in performance was largely due to the ramp in rapid diagnostics, i.e., rapid lateral flow SARS-CoV-2 testing. In the US this is the BinaxNOW test. Manufacturing has ramped to >100million per month and they were doing about 48 million rapid antigen tests per month at quarter’s end. This test which can be done at home and reported via a smart phone app is having rapid global uptake.

On the flip side, iRhythm Technologies (IRTC) that develops monitoring and diagnostic solutions for cardiac arrhythmias lost (-) 33% last week on the announcement of investigations over reimbursements as reported in Barron’s. eHealth, Inc. (EHTH) that provides internet-based health insurance agency services lost (-) 40% last week related to a strategic investment per Barron’s. Nothing is ever all that easy.

As I See It: The market made a rapid reversal that has weakened the short-term upward trend in the indexes. The significance of GME while entertaining is still conjectural. But that cake is baking.

February 1, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.