Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Slosh and Whoosh Markets

Last week the US stock market didn’t go down so much as it stopped going up. One could rightfully wonder if the anticipation of economic growth at some point in the future outpaces nearer term reality by too much.

The US equities are overbought accompanied by extreme bullish sentiment which generally is a setup for a change, either continuation or reversal. We have moved from rotating to chasing. Earnings and outlooks may help calibrate the market moves.

For now I have to consider this is a Slosh and Whoosh Market. The sloshing is all the liquidity in the system with much, much more on the way. Like all liquid it will flow to the lowest point. Gravity and all. The slosh is simply money sloshing from one side of the bucket to the other as the bucket swings this way and that. Good for traders. But not adding to forward momentum.

The Whoosh happens when the algos programmed-in-consensus models do something like a snipe hunt. Now and then when the sloshing is going on, somebody yells, “Hey I think I see one over here”. And Whoosh some combination of algo reset and options trades lead to massive movements of money and up or down movements in individual issue prices. It’s sort of fun but for most of us about as productive as looking for snipes.

Looking at the S&P sectors Whoosh has occurred as in the last week when carbon energy (XLE), materials (XLB), financials (XLF), and healthcare (XLV) exceeded both performance and momentum vs. SPX and the power of the moves was extreme. You might call this the algo and hope driven market. Hoping for a better outcome soon in Neverland to rationalize stock prices and guide future direction.

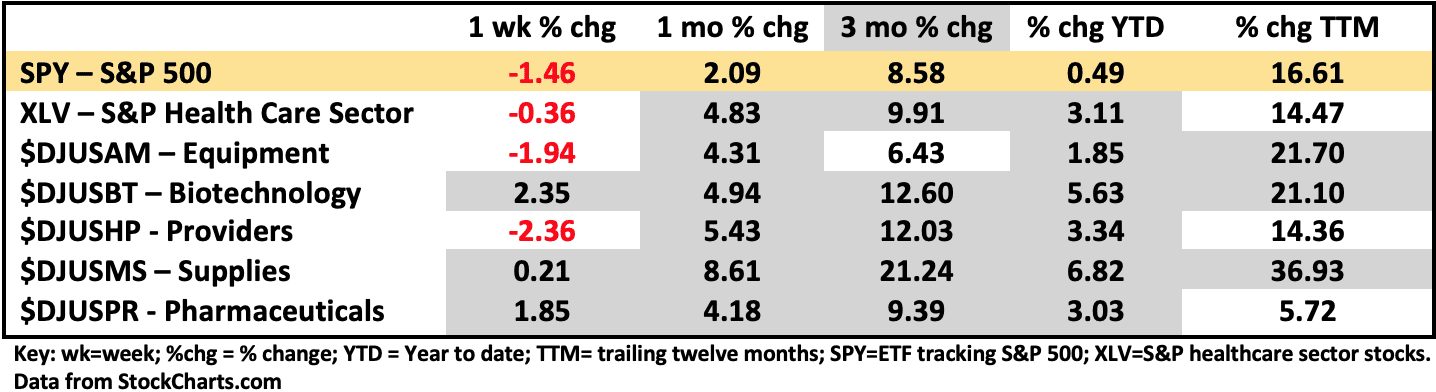

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 1/15/2021

The scorecard is getting a little interesting for the healthcare segments. Despite that XLV declined modestly on the week, looking at the chart of XLV, the last 10 sessions trace a bullish move followed by a consolidation in a bullish pattern that normally resolves to the upside. Even more interesting are the 1 and 3-month outperformance of XLV and almost uniformly the subsegments that comprise the XLV indicating broadening of participation.

With the pandemic in full bore it is a bit difficult to conjure specific fundamental cases for these stock areas different from what we just went through. One must conclude this outperformance may be largely technical in nature and part of the Slosh and Whoosh until we see how the fundamentals change with earnings and outlooks.

Earlier this month an excellent piece of analysis came from the Credit-Suisse research group and their overview of Healthcare Technology. The headline is Digital Health Now a Necessity Not a Convenience; 2021 to be a Realignment Year.

These researchers see the 2021 trends to drive digital health growth and innovations to include: continuing adoption of virtual care; increased focus on addressing mental health; continuing shift to home-based care; adoption of artificial intelligence and machine learning tools and applications; primary care reinvention; value-based care; and cybersecurity.

To further segment groupings of stocks in healthcare ETF’s check out the new ETF from August 2020 named EDOC that covers Telemedicine and Digital Health. It’s a decent view of market dynamics in this area.

As I See It: The US equities are trying to deal with so much liquidity and an extreme bullish sentiment that we are just sloshing and whooshing. Good for traders. I doubt a change is far in the future. Earnings and outlooks will eventually ground the market to some degree.

January 18, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.