Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Down – A 4-Letter Word

After a rousingly short 3-4 session corrective action, the US equities rallied last week. A bunch. Down is the new it four-letter word. The market simply won’t have it. Down is not socially acceptable. Don’t even say it. Buy the dips is now buy the blips. Today and always.

In the rhythm of the markets, earnings always reset the prices when projected becomes reality. As surmised, so far the firms that have been outperforming in the current circumstances continued to do so this quarter. While not a surprise it was reassuring from the stock perspective.

Doing the weekly analysis, seldom have the economic, fundamental and technical aspects of the market been as consistently aligned bullish as they are now. Of course, this coherence can last about as long as the last correction – 3 days – though the trends seem stronger. Anything can happen to rough up this happy occurrence. But the data are what the data are.

We know the broad strokes of the bull case – earnings beats, vaccines, fiscal and monetary stimulus, and projected-assumed economic expansion that is now early stage. The crux of the story is with small cap stocks (IJR, IWM) that gained +34% over the past three months.

The next important factor is a technical declaration in the Debt-Yield-Inflation-Currency Complex. After Treasuries seemingly moved both directions at once for a month or so, last week was way more decisive. If it persists it supports the bullish case for stocks in my view, handwringing about inflation aside.

Right now the story and the action in the market are bullishly aligned, at least for a week.

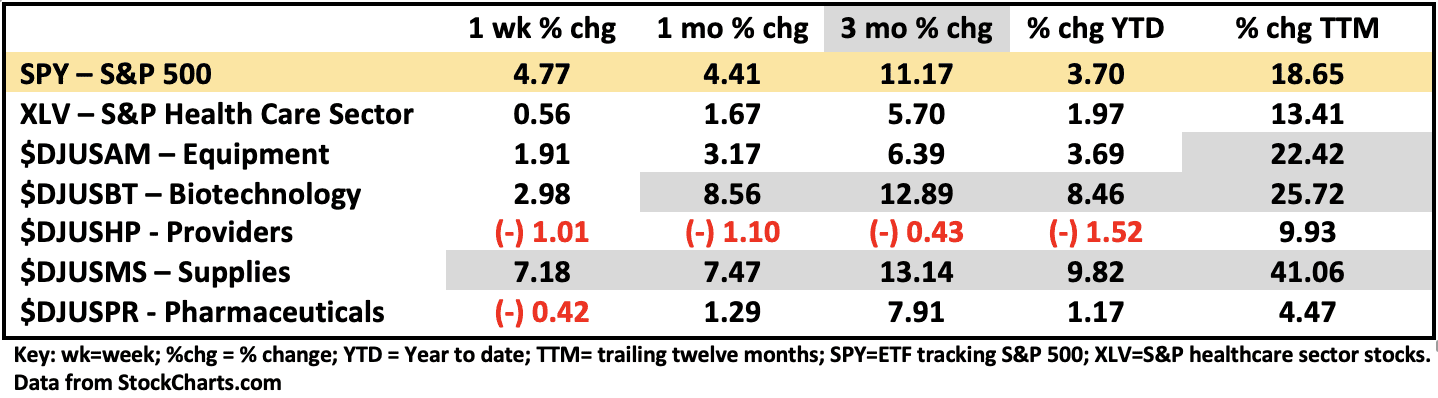

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 2/5/2021

While the broader market was in rally mode last week, healthcare (XLV) was the worst performing sector on the week. Weakest sector in a monster rally is never a good place to be.

Medical Supplies ($DJUSMS) have been the most consistently productive healthcare stocks for over a year. Last week was no exception. No other part of healthcare was close. Leaders of more established issues included large cap Align Technology (ALGN) a provider of dentistry products up +18% for the week on outstanding earnings. Haemonetics (HAE) a mid-cap provider of hematology products and solutions was +22% on the week. Small-cap safety needle manufacturer Retractable Technologies (RVP) gained +18% on the week.

Biotechnology ($USDJBT) has shown consistent market outperformance for that past year. In biotech the smaller firms with actual products and revenue outperform the larger firms in general. Best large cap biotech last week was AbbVie (ABBV) +6.10% on earnings and news. Novavax (NVAX) was +31% on vaccine news.

Biotech IPOs continue to come to market at a healthy pace. 2020 had record number of funding events with 81 IPOs raising $13.5 Billion per Biospace. On Friday, seven biotechs came to market. Included in this clutch were Lucira Health (LHDX) actually a maker of Covid test kits, Terns (TERN), Immunocore Holdings (IMCR), Bolt (BOLT), Vor Biopharma (VOR), Sana (SANA), Landos (LABP), Sensei (SENSEI).

Conditions are ideal for biotech companies to come to market by IPO or SPAC. We are in the waste capital market. The vast majority of biotech companies will not reach significant revenue and will not succeed. They sell a concept and when public their only product is their stock. Buyer beware.

As I See It: Big tech earnings, fiscal stimulus, vaccines conspired to rally stocks. Tech and SMIDs drove the gains. Stocks + Treasuries + US dollar + commodities + technical analysis all signal an economic growth scenario and a bullish stock market. Stay tuned to see if it works that way.

February 8, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.