Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Echo Trade

It is not uncommon to see a very strong move one week, like indexes up around +5% in the week ending February 5, followed by this past week where SPY gained +1.27%. I call these “echo” trades.

It’s like we didn’t have any new ideas so we did the same thing again. This time we saw a less energetic market, like an echo, and a progressive contraction of buyers. No particular sellers either. Just falling volume. And there are signs of the broader market getting overbought but not especially exuberant. Consolidation and continuation are ok. So are the short 3-5% pullbacks we’ve seen as we ascended this past 11 months.

The growth story persists on the indexes this week. The SMIDs continue to outperform. IJR (S&P 600 small caps) +3.59%, IWM (Russell 2000) +2.53%, and the IWC (Russell microcaps) + 3.85% vs. SPY of +1.27%. I have particularly enjoyed the return of the microcaps.

Looking at new 52-week highs, most of the indexes achieved this but not the S&P sectors as the rotation from large cap to SMID has played out. This next observation may be biased by my own tendency to follow technology market slivers, but hitting new highs were lots of these including biotech (XBI), semiconductors (SMH), internet (FDN), software (IGV), clean energy (QCLN), and robotics-AI (ROBT) among others.

As the market continued this week, what is the next market motivator? Fed and fiscal stimulus are anticipated and not new. Earnings season is wrapping up and has had its impact for the most part in the current cycle. Market movement will depend on economic data and geopolitics one thinks and will likely respond poorly to either diminished stimulus or new Covid-vaccine negative news. In the meantime, price momentum in the VIX is down. Price momentum in the market is up.

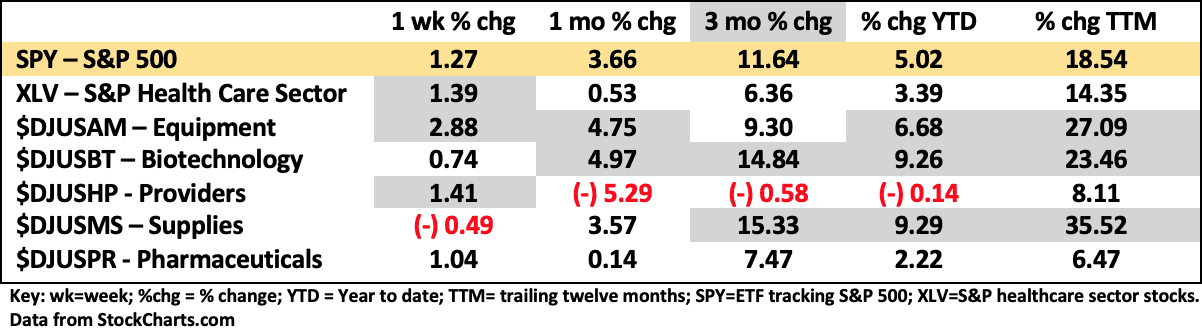

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 2/12/2021

Healthcare (XLV) continues to underperform across longer time frames than one week, but last week was a little on the plus side of SPY. Why the focus on relative performance and relative strength?

Looking at valuation and stock performance, relative strength plays a significant role in market tolerance for higher valuations. Also growth rate itself. Not only do we look at trends, momentum and relative performance we also look at revenue growth, gross margin expansion, EBITDA growth and free cashflow growth. All of these by some measure are associated with future earnings, the driver of price for growth.

The XLV has two subsectors – providers ($DJUSHP) and pharma ($DJUSPR) – that are slow movers. They are so large that added revenue under $1 billion is not that helpful, and the market network within which they function make decisions slowly if ever. Providers historically are challenged to achieve benefits realization from new technologies and hence often view them as a cost with marginal benefits unlike many industries.

The medical equipment sector ($DJUSAM) while usually an area of innovation and growth has been impacted by the Covid pandemic with the suspension of elective procedures. It seems likely this area will become part of the reopen-recovery story as the virus becomes less of an issue. Providers are very keen to restart the procedure assembly line. $DJUSAM has continued to outperform SPY mostly due to diversification. When an area outperforms in troubled times, generally it is a good place to look for opportunity.

A couple of call outs for YTD performance in large cap equipment are the measurement and analytics company Waters Corp (WAT) +14.76 on earnings growth. Specialty chemicals for research applications developer Bio-Rad (BIO) is +13.62 YTD on revenue growth and FDA approval of their Covid test.

As I See It: This week saw an echo continuation of the prior week’s extremely strong bullish move. There were no specific changes in trends except perhaps the VIX which if its trend confirms should continue to move lower and stock prices higher. Most signs point to continued bullishness. Until they don’t.

February 15, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.