Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

When Money Meets Momentum

Momentum markets are story markets – aka forward looking fabrications – and decoupled from actual occurrences. In today’s world algos are the social media of conventional wisdom and group think as represented in market recalibrations perpetrated by algo adjustments. Call it a rotation if you like. The move was significant in 2021 Week 1. What now?

I enjoy conventional wisdom in the same way I like soothing music. It’s smooth. It feels good. Calms the nerves, assuages the fears. The story fits with preexisting beliefs and thus feels rational. Numerous illustrations if not useful analysis can be presented to bolster the case. It almost makes me believe I can predict the future.

For those counting, the first week of trading in 2021 occurring in the teeth of pandemic death and destruction as well as a first experience in our history of a sitting president inciting violence against the government he is sworn to protect, the results were OK. More of the same. Broad participation, decent volumes, SMIDs (small and mid-caps) outperforming SPY, and equal weight indexes outperforming market cap weighted ones. Picking up where we left off.

Some industry slivers went parabolic like green energy (e.g., PBW, QCLN, ICLN), genomics (ARKG), and bitcoin ($BTCUSD). But the S&P sectors outperforming SPY were a healthy mix: financials (XLF-yield curve), discretionary (XLY-autos/TSLA), materials (XLB-metals and chemicals), and healthcare (XLV-supplies and providers). Not a bad start.

It was a continuation trade. There are many questions and unresolved issues as we look to 2021. There is so much money out there and more coming. Can we use it productively?

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

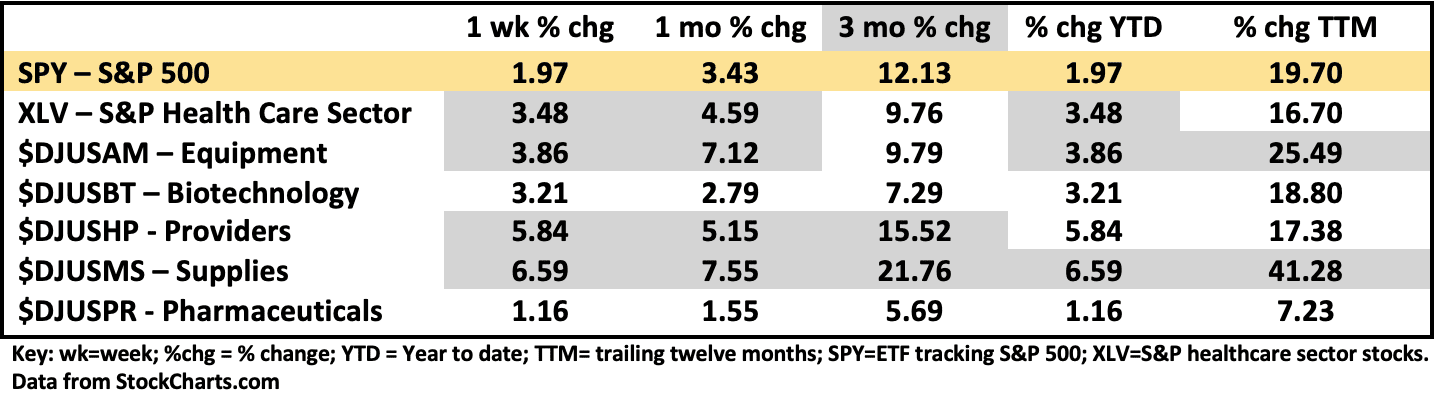

Healthcare Segment Scorecard - as of close of market 1/8/2021

The healthcare sector ETF (XLV) has taken a little run in the short term. The chart shows a price breakout to the upside over three sessions. Momentum and volume measures confirm stock accumulation by investors. Healthcare is now part of the rotation and reopening stories at least this week. We can conjecture why this might be true. Looking at seasonality, January is the second-best month of the year historically for XLV. Historical data are interesting primarily as a statement of pre-test probability.

Within the XLV, however, the pattern of performance didn’t change. The leaders continue to be supplies ($DJUSMS), equipment ($DJUSAM), and a recent addition, providers ($DJUSHP). Providers showed a pop in November and then a second one last week, the combined effect is reflected in the 3-month performance.

Biotech and Pharma continue to underperform in these broad industry groupings. So let’s look at some different slices of healthcare. One managed ETF that has gotten a lot of press is ARK Genomic Revolution Multi-sector ETF (ARKG) that gained 13.5% in the past week.

An aside, an old market adage and there are hundreds of them says if you got your idea from reading about it in the press, the easy money has been made. In this case, however, this is an area where momentum is huge and actual breakthroughs are expected over the longer haul. It’s an area we probably want to know.

Within ARKG last week’s top performers included Arcturus Therapeutics (ARCT) gaining +60.6% on the week. They are in the RNA therapeutics biz. Another was Intellia Therapeutics (NTLA) gaining +44% last week. Intellia engages in gene-editing based therapies. A third is Pacific Biosciences (PACB) gaining +41% on the week. PACB develops, manufactures and sells an integrated platform for genetic analysis. These are all small cap stocks.

As I See It: Last week for stocks was more or less a continuation of what had happened from November onward. One hopes with resolution of some things we could just settle down some. But when money meets momentum, keep your seatbelts fastened. Going in either direction.

January 11, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.