Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Which R You?

In markets there is the movement and there is the story. The story this past week could be that the market went down because (choose as many as apply): Reversal, Reset, Regression, Rotation or Repricing. Which R are you?

In essence, the only factor story is rising Treasury yields that suggest economic activity could return to pre-Covid levels. I’m going with algo reset as the dominant story. I’m also going with a T as in market in transition.

Although the week’s action felt lousy, so far we had a short (6 session) correction in the $NDX (QQQ) and less on the other indexes. The Q’s were (-) 5.10% on the week on very large volumes and QQQ is now (-) 7.00% off of 52-week highs, a reasonable correction. QQQ has still gained +46% over the trailing twelve months.

Here are some interesting counterbalances to the QQQ performance. Transports (IYT) gained +0.40 on the week vs. SPY at (-) 2.48%. This is the same pattern as last week and inconsistent with an economy falling out of bed but more like repricing. And SMIDs outperformed SPY being less negative with MDY (-) 1.52% and IJR at (-) 0.85%. Technicians opine that this pattern of SMID outperformance is likely to persist in a rising interest rate environment.

We seem to be in a market in transition. We knew we would get here someday. This is just the beginning of imagining the next stage of life with Covid, this time with vaccines. The next few months are likely to bring more changes and resets, some foreseen and some not.

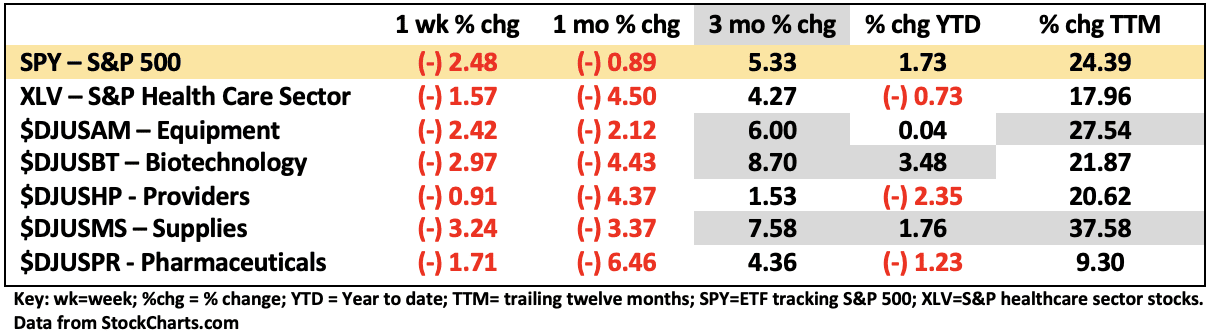

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 2/26/2021

Healthcare (XLV) continues to underperform and the hole gets deeper. The entire healthcare sector (XLV) and all of the industry segments making up the XLV are priced below their 50-day EMA consistent with a significantly long corrective period for these stocks. Based on the pricing behavior evident on their charts there is no reason to believe this situation will change soon, though of course it could if earnings start to outperform the market. Additionally, the technical features of these stocks are beginning to look oversold which means there could be increased buying in the near future.

One dynamic to be aware of is the relative performance between current price and the TTM %-change (trailing twelve months). TTM %-change includes the prices at the beginning of Covid-19, the subsequent selloff and then the eleven-month bull run we have sustained to today’s prices. The %-change off the 52-week low for the major indexes like SPY is astounding and runs in the 100% range. By comparison healthcare stocks are one of the weakest areas of the market performing at about half that strength.

Both biotech ($DJUSBT, XBI, IBB) and pharma ($DJUSPR, PPH) have been taken to the woodshed and are enduring significant price corrections. What passes for fundamentals in biotech often is not useful for determining valuations. Many of these companies have little or no revenue and seldom have bottom line growth until they become very large and begin to resemble their slow-moving cousins in pharma.

During high momentum markets which are story markets biotech tends to soar along with other tech stocks with a story like EV, cryptocurrency and others. Regardless of the reason many of the smaller biotech firms had negative stock moves last week in the (-) 15-30% range. That leaves a mark.

As I See It: We seem to be in the early stages of the market’s transition from full Covid impact to continuation Covid with vaccines. There was really no news to report last week of a particularly negative nature. The noise around yields and inflation is worth monitoring. In the meantime, algos will reset as algos do.

March 1, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.