Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Imagination Meets Machine

As adaptation continues in the Age of Covid, market transitions such as the one we are now in occur at the nexus of imagination and machine. The pixels of probability are filling the picture of possible futures to the point that we can begin not only to imagine a vaccine-ordered outcome but also begin to see it in real time.

These probabilities form the basis of our current group beliefs which inform our group behavior. The machines execute our collective beliefs at the speed of light through our algorithms and we get market prices.

One of the stock market’s bit of self-imagination is the description of itself as a forward-looking mechanism. Yet it reports what happens in real time. A human tendency that is prevalent when imagination meets machine is mental foreshortening. This is part of the forward-looking belief where although we can see the destination we are less competent understanding distance and time and predicting countervailing events. This seems especially relevant when we are dealing with the Age of Covid which is a new event of its type.

Over the past month transports (IYT) are + 6.71% one of the better performance areas vs. SPY loss of (-) 1.05%. Adding to the one-month winners are small (IJR) + 4.00% and mid-caps (MDY) + 1.45%, collectively the SMIDs. RSP the equal weight version of the S&P 500 for one month gained +3.41% vs. SPY’s loss, implying the major losses occurred in the largest cap stocks, the same ones dragging down QQQ with (-) 6.84% on the month.

I doubt that technology is rolling over for the long term. Too much of our future activity requires it. Equally the case is likely that it will not see another +47% over a trailing 12-month period as is the case at this moment

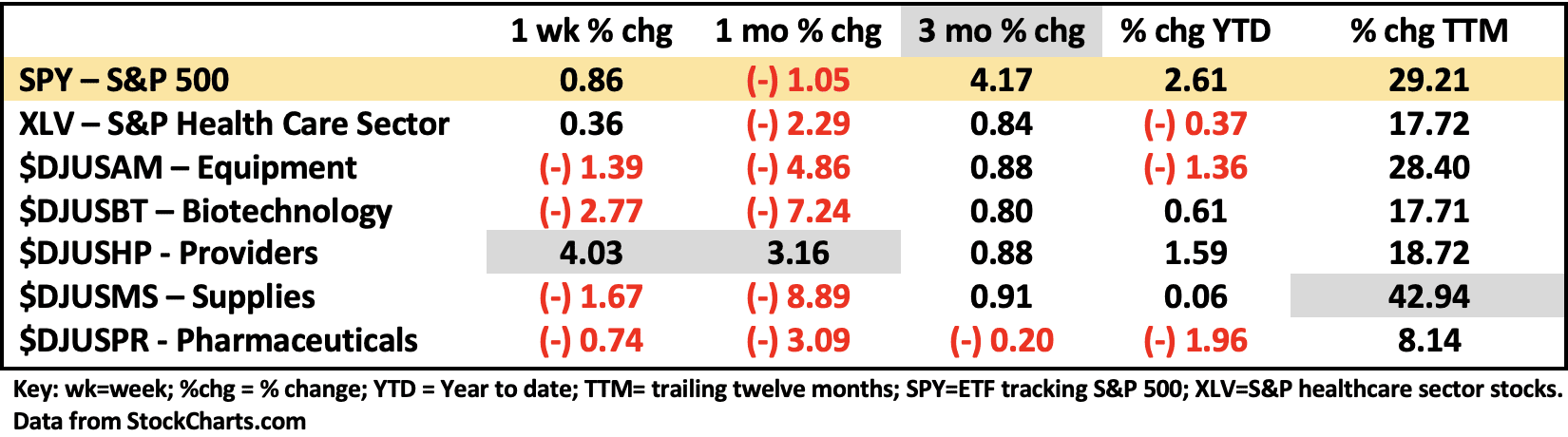

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 3/5/2021

Healthcare (XLV) had a small gain this past week but less than SPY. For the last six weeks, XLV has become a very unloved sector of the market and one of the weakest on a relative strength basis. There was a bit of buying on Friday in XLV. It could be technical in nature as the sector ETF was very oversold.

Providers ($DJUSHP) popped +4.03 with almost all the gain coming on Friday. It is a trend reversal, unlike all the other industry groups that are part of XLV that have been selling more or less in concert. There is no clear reason for it other than it moved with the parts of the market that also rallied. Perhaps providers are part of the reopen trade as the case rate of Covid falls and revenue lines are reestablished.

When an industry group suddenly changes direction, it can be helpful to see who led the charge. In this case the big guys led the way including Anthem (ANTM) +10% for the week, Cigna (CI) +9.9%, and Humana (HUM) +5.2%. Among small cap providers the chiropractic operator Joint Corp (JYNT) gained +10.7% for the week on good earnings.

XLV also contains a lot of rapid growing and high-flying stocks like in the biotech group ($DJUSBT) which has been hammered the last three weeks down about (-) 11% from 52-week highs. XBI the biotech ETF is (-) 20% from 52-week highs.

Some examples of reversal of fortune contributing to the biotech woe include Covid vaccine stocks such as Novavax (NVAX) down (-) 24% on the week; Inovio (INO) down (-) 17%; Moderna (MRNA) lost (-) 15%. Digital didn’t fare much better in some cases. Drug discovery stock Schrodinger (SDGR) lost (-) 32% while Teladoc (TDOC) lost (-) 14%. These subsectors are part of the out of favor trade in technology in general.

As I See It: The stock market appears to be in a transition from the acute Covid response to a life with Covid where vaccines are impactful and broader economic activity returns. Where, when and how much growth happens this year remains to be determined. Imagination will meet machines in next earnings season.

March 8, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.