Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

3-Factor Market

When we lack fresh insights based on actual events, market behavior tends to get narrow and repetitive. As they say, don’t fight the tape. Or every trade extends till it stops. You know those old sayings.

The US stock market has been operating based on three factors lately: momentum and a binary on-off switch of Treasury bond yields vs. technology stock valuation. It’s a trader’s dream. In times of transition which come with increased uncertainty, we often resort to this sort of trading while we wait for the next news, earnings season.

The momentum market which has been with us for a few months now has shifted focus from large-cap technology to small cap (IJR) up +25% YTD and micro caps (IWC) up + 34% YTD and to lesser degree mid-caps (MDY) up +15% YTD. Momentum is a story play. The story is the one about reopening and vaccines. The other story is about inflation.

The binary trade that dominates the headlines and every wasted breath of every commentator out there is the narrowly linked trade between Treasury yields and technology companies as represented in QQQ ($NDX). Click, click. It’s purely mechanical and algo driven based on a common belief about a model.

Participation has continued to broaden as RSP (equal weight S&P 500) gained +11% YTD vs. SPY + 5.4%.

The bull market continued last week. Do we go mo? And invest in the current momentum stocks that have been running since November? Or do we now look to the corrected stocks in technology to add new money? Or both? So confusing. And what do we do about Bitcoin for heaven’s sake?

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

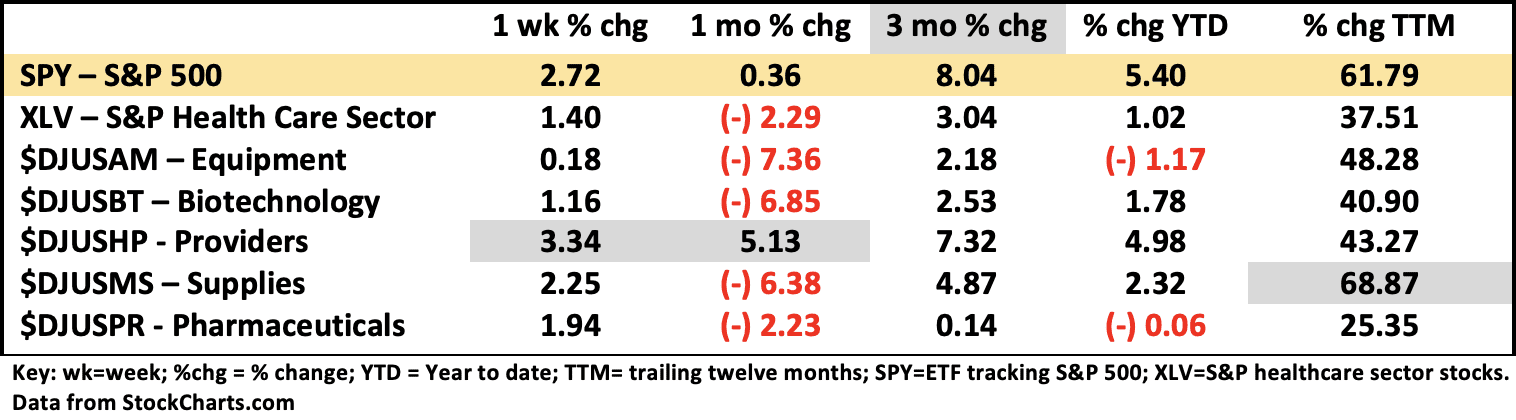

Healthcare Segment Scorecard - as of close of market 3/12/2021

Healthcare sector (XLV) and all five of its industry groups had gains this past week as the broader market and breadth of buying lifted all boats, even healthcare ones that are none too healthy. Only providers ($DJUSHP) gaining +3.34% continued to outperform the broader market index. Looking at seasonality, XLV has its weakest performances in February, March and October on average over the last five years. It certainly neither deviated from pattern nor disappointed expectations this year so far.

Stock price fundamentals such as valuation metrics and other basic business performance metrics allows one to say what should happen next. Looking at the chart of daily price movement tells you what actually happens, all brilliant insights notwithstanding. Both are valuable tools for understanding market dynamics.

What is the behavior of the price action? XLV over the last year (TTM) gained +38%, puny compared to SPY’s +62%, but a gain nonetheless. The pattern has remained bullish meaning rising trends and higher highs and lows. A 52-week high was recorded on January 26 and since then there has been a correction meaning net selling. The net distribution of stocks in XLV has been very large which means institutions have been rotating out of healthcare in large amounts. Relative strength is one of the worst in the market. The last two weeks, stirrings of positive price momentum are apparent. Watch for follow through.

Participation in $DJUSHP, the providers was broader this week. In addition to Cigna (CI) at +6.02%, clinical lab company NeoGenomics a mid-cap stock was +13.8% on the week, and small cap senior living operator Capital Sr living Corp was +29% on the week. The providers across the board seem to be responding to the impact of vaccines. The small and mid-cap biotechs with Covid-related vaccines or treatments were up last week as well.

As I See It: A bullish week in a bullish market. It is healthy to sustain a correction in a dramatically overbought QQQ without crashing the whole market. SMIDs are overbought to extreme. Earnings beckon. We need some real data. In the meantime we probably have to endure both momentum and the repetitive binary trade.

March 15, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.