Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Believe Until it Breaks

Belief drives behavior. The market generally sets up the question, “How much do you believe? How much will you risk on your beliefs?” Then it proceeds to drive a trade to test your belief even to extremes.

The story has been widely accepted: rapid (?explosive) economic recovery from Covid, impact of vaccines, rising inflation represented in rising long-maturity Treasury yields with the mechanical reciprocal selling of growth valuations, and a continuation of momentum trading with emphasis on different sector stories but still a momentum trade.

Let’s say you believe in the inflation story. How much? How much is too much? What is different this time? The Fed and other central banks have been trying to cause inflation since 2009 with little success. What has changed of substance and sustainability?

If you have even a drop of contrarian blood in you, two things. Inflation is now the number one fear of fund managers and bullish sentiment is now the case in every survey. We all believe the same story about recovery and inflation apparently. Time to make a plan.

Last week saw a negative turn at the index level, though deeper in the market metrics lie other messages. On the week SPY was (-) 0.84%, QQQ (-) 0.74%, MDY (-) 1.25%, and IJR (-) 3.17%.

The summary this week is not a lot happened at the headline level. To and fro we go. But inside the market is continued strength and the appearance that technology and parts of healthcare may be ready to join the bullish market. Not definitive but worth a follow.

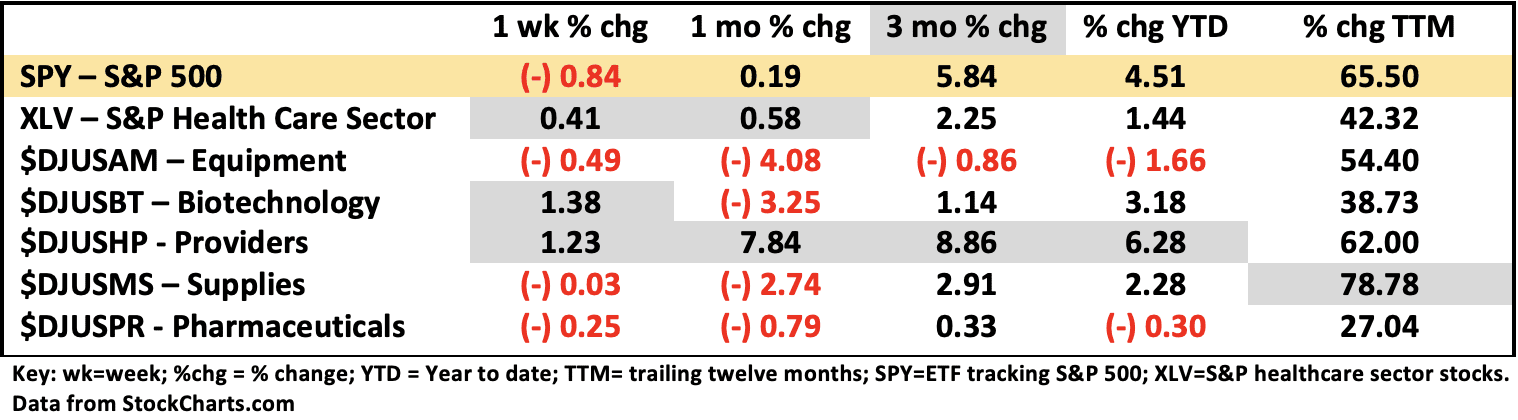

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 3/19/2021

Before we get to healthcare specifics it is well to recognize the great “normalization” in TTM is upon us. The amount and speed of stock price gain since the bottom of the Covid crash is unprecedented as was the speed of the crash. SPY bottomed on March 23, 2020 and gained +65% to the close on March 19, 2021.

This is a historical variance and divergence from normal level of activity that likely will neither persist nor be repeated as a next move. Part of the debate playing out in the market now is how this all readjusts. It is more of reset of a rate of change than absolute numbers. It’s different.

The healthcare sector (XLV) is showing a little life extending to one month of outperformance of SPY. This is not crazy upside, just a little north of the benchmark. Providers ($DJUSHP) and biotech ($DJUSBT) turned in a positive week and providers are now the leading industry group YTD. The rest of the sector components continue to move largely sideways after significant corrections with continued net distribution or selling.

In the provider group there is relatively decent participation. The big stocks continue to show gains with Anthem (ANTM) +3.63%, Quest (DGX) +2.80%, UnitedHealth (UNH) +2.69%. In the small cap space Capital Senior Living continued an upward trajectory with +11.5% for the week on news that they have completed the second round of vaccinations in their facilities resulting in a 99+% decline in Covid cases.

Continuing the Covid news theme, the biotechs are starting to show some life. Both ETFs closely followed, IBB and XBI, are looking like a continuation trade but with internal strengthening, a positive rate of change, and positive on balance volume. Novavax (NVAX) gained +12.5% last week and Amgen (AMGN) gained 6.8%. Moderna (MRNA) and Gilead (GILD) contributed gaining 4.9% and 4.7% respectively.

As I See It: A negative week at the headline level without significant technical impact and a lot of internal bullish participation. Market mainly expects strong GDP and earnings growth upcoming. Anything less will be a huge disappointment.

March 22, 2021

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to bob@greenroomtx.com

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.