Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Whoa! What Just Happened?

This was the good-times-a’comin’ rally. It is generally a sign of good market health when leading sectors mark time while lagging sectors outperform for a bit. The sectors that have markedly underperformed in 2020 could outperform hugely for months and not really catch up. Let’s see what you got.

Because what we do have is Covid-19. Lots and lots of Covid-19. And an announcement of next step success with two vaccines. Not a vaccine in hand. Not a freezer full of the stuff at minus a bunch of degrees C shipping off to save the world. But a positive step nonetheless. One that makes us all expectant.

The week’s summary is: SPY +2.27%, QQQ (-) 1.25%, MDY +4.33%, IJR +7.38. But this result doesn’t do justice to the volatility and absolute bizarreness that was the market this week.

The stock market roared upwards on Monday based on vaccine and other news, only to end in a heap at the end of day. There was a participation in stocks that have underperformed YTD so far. Call it a rotation.

Was the vaccine news an example of salience bias? This cognitive bias causes us to focus more on emotionally striking events even if there is no difference between these events and others and is often used in product sales and advertising. Or perhaps the vaccine news caused foreshortening bias, our tendency to see the solution but misjudge the distance to the goal, either in time or effort or unforeseen obstacles. Whatever it was the market ended the week in full bullish regalia.

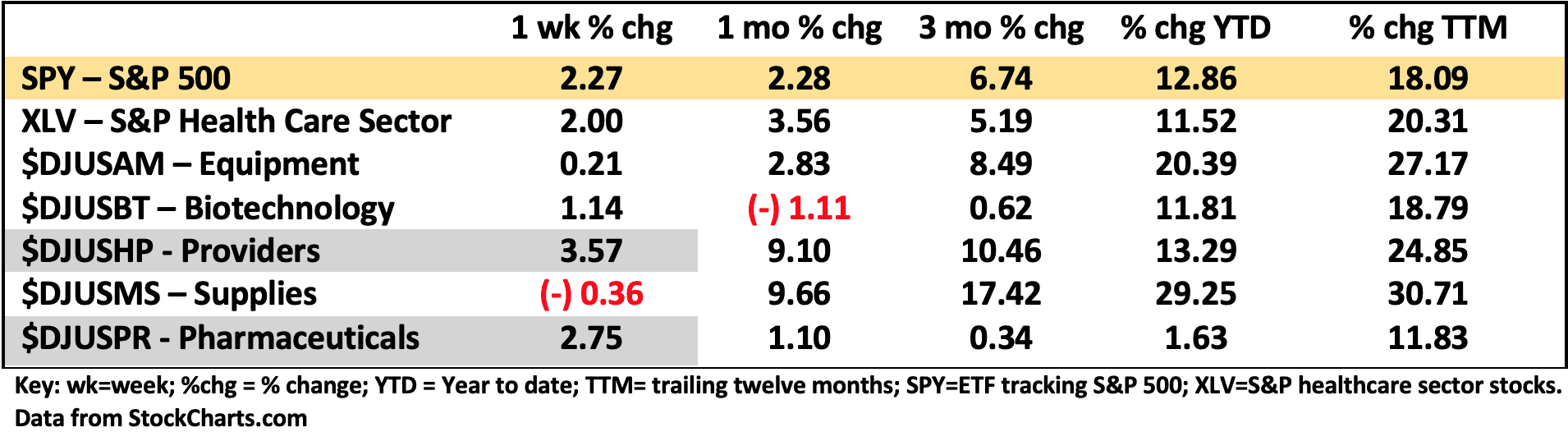

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 11/13/2020

Although the S&P 500 hit a fresh all-time high last week, so did the S&P healthcare sector ETF (XLV). Outperformance was again shown by the provider group ($DJUSHP) but also Pharma ($DJUSPR). Given the focus on vaccine news we might have expected more market recognition in broader Pharma and Biotech.

Another part of the general market rotation that should be considered in healthcare as well is the impact of the dramatic outperformance last week of small caps – e.g., IJR (S&P 600 small caps) at +7.38% and mid-caps – e.g. MDY (S&P 400 mid-caps) at +4.33% vs. SPY +2.27%. The Russell 2000 (IWM) also a small cap index hit a fresh all-time high.

Strength in the smaller stocks helps ETF’s such as XBI (biotech) and XHE (medical devices) that recognize the performance of the smaller stocks. On the week XBI ended +4.31% vs. broader Biotech ($DJUSBT) +1.14% and XLV +2.00%, while XHE was +3.07.

As expected some vaccine stocks skied. CureVac (CVAC) gained 49% on the week and Moderna (MRNA) gained 23% on the week. BioNTech (BNTX) Pfizer’s (PFE) vaccine partner gained +15.2%.

Providers ($DJUSHP) continued to outperform with large caps such as Universal Health (UHS) gaining +14.2% and DaVita (DVA) gaining +12.1%. Some smaller cap providers like US Physical Therapy (USPH) did well gaining +19%. Big pharma outperformed as a group and notable gains were seen in the Covid-19 plays like Pfizer (PFE) at +6.10% which sustained its largest one day move in history on Monday.

As I See It: The market is bullish by just about any parameter you can put up. This, of course, in the teeth of the new surge in Covid-19 of uncertain impact but not expected to be good. It seems to me we have somewhere between 2 and 6 months before we start seeing real positive impact on the virus by whatever means. And longer for measurable vaccine impact. The markets may or may not care.

November 16, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.