Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Elections and Markets

George Box won the election! “All models are wrong, but some are useful”. The polling people are palpating their insights. It is a state-of-the-art moment for big data, algorithms, and artificial intelligence, emphasis on artificial.

Of course to predict the outcome of this particular election correctly in advance, the models would have had to predict that the last flip of the coin would leave the coin standing on its edge with the result 50-50 give or take.

The markets in the meantime are over the election. They moved on last week with the S&P 500 gaining +7.32% on the week and the Nasdaq 100 gaining +9.37%. Seems they also dismissed the Covid pandemic as a negative. As of today and the combination of election results and vaccine news new highs have been achieved on the indexes.

Markets and elections give similar information. As Benjamin Graham observed, “In the short run, the market is a voting machine….” Both sets of transactions are a record of mass human behavior, real-time in the case of stock markets and contemporaneous in the case of elections.

Tally the transactions, sure. But then one must try for insight as to the meaning of the tally. Both sets of transactions cause emotions. To understand the message of stock markets or from an election requires

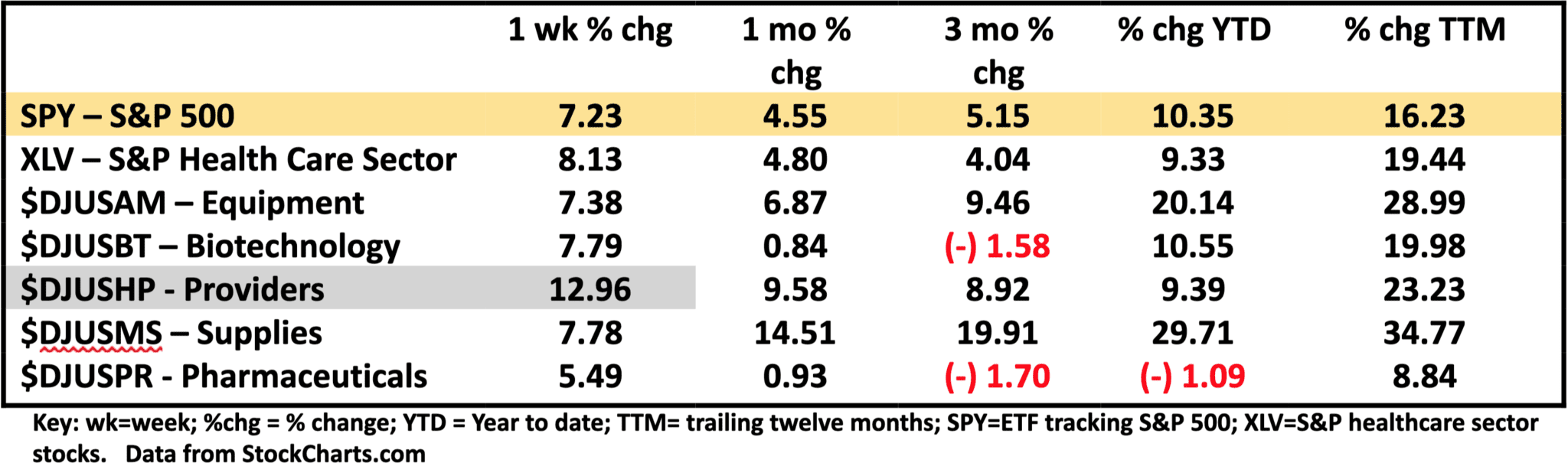

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 11/6/2020

After underperforming the S&P 500 since April of this year, the healthcare sector ETF (XLV) achieve a new 52-week high last week on the outperformance of the provider group ($DJUSHP) which gained nearly +13%. There was broad participation within the provider group in the gains. Today it’s pharma up +3.4% already.

Many analysts feel this buying is due to the outcome of the election producing split power in government, meaning there won’t be drastic changes in healthcare policy or payment. Business as usual. The political policy projections undoubtedly played a role and the provider performance is illustrative of the impact of algos in today’s market that result in rapid and large shifts in price when factors affecting model projections change.

Another likely factor is historical seasonal activity inferring past behavior will reoccur this year. November is the strongest performance month for healthcare on average over the past five years. XLV, biotech, providers, and supplies have gained in November 100% of the time over the last five years. And equipment and pharma have done so 80% of the time.

Biotech, supplies and equipment all outperformed slightly compared to market last week, continuing longer-term trends. Pharma as has been usual underperforms. Given the seasonality of these stocks, they likely will continue to outperform over the next few months.

The overall market also has a favorable seasonal period from the end of October to the middle of January. The S&P 500 has showed gains in 61 of the last 70 years and technical analyst Tom Bowley sees more of the same this year. Believe it. Don’t believe it. It’s a point of view.

As I See It: We have some vaccine news and we have positive seasonal expectations. We continue to follow the Age of Covid market story. This is driven by companies that are doing well + vaccine and treatments for Covid available sometime in the future + Fed’s monetary policy +/- Congress doing something…anything.

November 9, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.