Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Virus vs. No Virus. Market Stalls.

Last week the stock market at the headline level stalled out. Both momentum and volume of trades fell. But there are two factors supporting prices on the downside: Federal Reserve policies and progress on vaccines.

The bulls and bears are duking it out over speed of impact of vaccines, as the Fed policy is a given. There has been a type of rotation or at least a broadening of participation of stocks whose prices were beaten down since the pandemic but who successfully adapted.

Here’s the problem from my perspective. For the current participation to be sustainable near-term requires that the economy grow. There is no sign that will happen in the amount necessary in the next three months.

The pandemic is surging without sign of relief. The next round of closures, bankruptcies, and loss of unemployment support despite the directionally good news on vaccines is still in front of us. A potential caveat that may support continued growth is faster recovery outside the US. The US itself – not the market necessarily – is a mess at the moment.

This week indexes closed SPY (-) 0.77%, QQQ (-) 0.19%, MDY +1,61%, IJR +2.63. The outperformance of smaller stocks is a good sign along with the broadening participation of sectors in general. The rotation out of pandemic winners is real and has now persisted for 3 months. One way to think about the rotation is to avoid conventional labels like “value” and “growth” when looking at stocks. Categorize stocks that either “work” for you or “don’t work”. Buy the former. Sell the latter. I know, seems obvious.

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

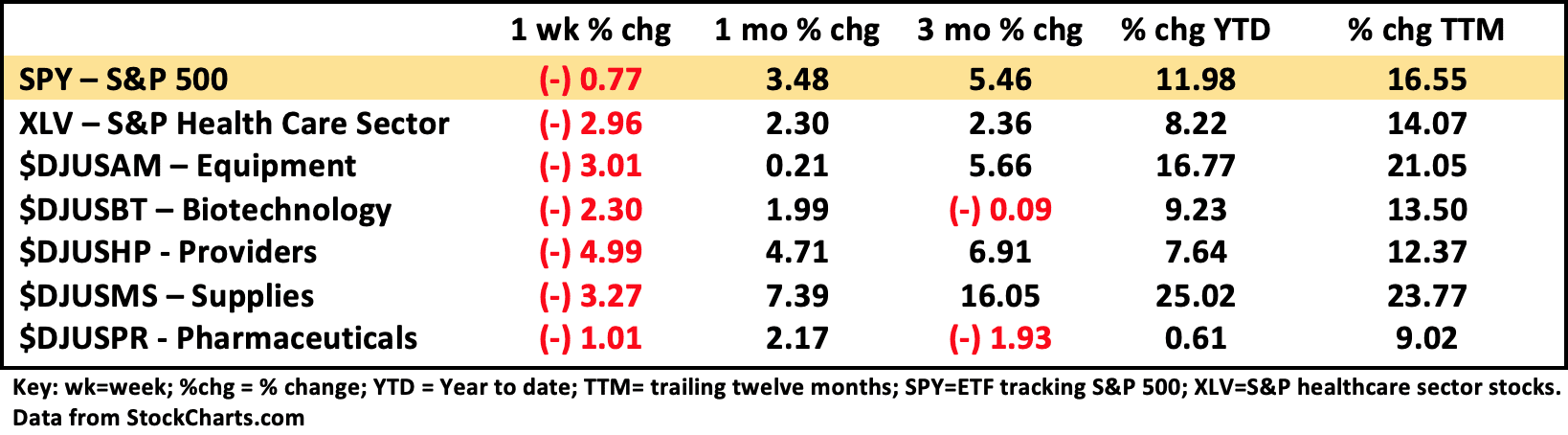

Healthcare Segment Scorecard - as of close of market 11/20/2020

The S&P healthcare sector ETF (XLV) took a significant hit last week along with all the constituent sectors. Selling was across the board. The assumption is with the resurgence of Covid-19 some of the same uncertainties that reared up earlier in the experience may recur. Essentially, the healthcare stocks peaked relative performance in April and have been underperforming since then. Last week was another leg down.

It is instructive to look beyond the large market cap companies and look at the smaller ones. Strength in the smaller stocks helps ETF’s such as XBI (biotech) and XHE (medical devices) that recognize the performance of the smaller stocks. On the week XBI ended up a little +0.80% vs. broader Biotech ($DJUSBT) down (-) 2.30 while XHE was down a fraction (-) 0.65% vs. (-) 3.0% for the broader equipment sector ($DJUSAM). Digital health stocks buried in software sectors did well last week in general.

The Covid-19 vaccine stocks had an odd week. Moderna (MRNA) the latest to announce progress with its vaccine gained +9.22% on the week. Pfizer (PFE) the prior week’s darling who also reported more progress was up only +0.24% on the week and its partner BioNTech (BNTX) was down (-) 1.82. AstraZeneca (AZN) also reporting progress with a vaccine was down (-) 3.62%. The headlines obviously don’t drive the whole story.

Providers got hammered last week reversing their up move from the prior couple of weeks. Uncertainty about the virus played a role no doubt. Equipment also lost altitude related to uncertainty about procedures. But surprisingly supplies $DJUSMS also got hammered down (-) 3.27%. This possibly demonstrates the impact of selling within a sector. Everything goes down. Broader biotech ($DJUSBT) down (-) 2.30% and pharma ($DJUSPR) down (-) 1.01% remain surprisingly weak.

As I See It: We are still mostly in a momentum market and disconnected from actual occurrences. There are a couple very strong market price support mechanisms in play likely limiting downside: Fed policies and progress on vaccines. Whether we rocket higher or not seems not that likely to me, but if the progress on vaccines accelerates, it could happen. Maybe that would give better visibility and an upward bias to healthcare.

November 23, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.