Green Room Technologies

Turning Good Ideas into Good Business.

Green Room specializes in business, market and technology readiness. Our clients are health tech companies with medical device and software products and investors interested in health technology. Our services enhance innovation, interoperability, growth and investment potential.

The Health Tech Market: A US Equity Market Point of View

As entrepreneurs who aspire to either become a publicly traded company or be bought by one, understanding the dynamics of the public markets is fundamental to achieving your ultimate liquidity goal. It is one bookend of valuation.

Virus and Vaccines

It’s like the market last week said, “Oh, right, a virus.” For whatever reasons the market has been ignoring the impact of Covid for several months. It seems true enough that none of us knew how things would play out, that there are businesses that thrive in pandemics and those that are destroyed and those that are in between and the stocks will behave accordingly.

OK, now we know. It’s also like we suddenly realized the tyranny of arithmetic. Just because we go down 30% in one quarter and then go up 30% the next quarter doesn’t mean we are back where we started. We are in the adaptive slog phase of the pandemic.

Despite the fact that everything sold off last week, it happened in smaller or bigger dollops. So far, it is a correction of the rapid kind, the kind we have been seeing for a time. SPY finished (-) 5.56%, QQQ (-) 5.39%, MDY (-) 5.77%, and IJR (-) 6.08%.

This brings me to why we start with a point of view. All markets are full of opinions and beliefs and hot news noise. Most of the time these don’t rise to the level of a fully formed point of view, a systematic way of looking at the market that leads to a plan to take action. Or at the very least to provide insight how value is both created and realized in the market.

A fully formed point of view usually comes with a context, a perspective and a focus especially across a defined period of time. It prevents following market movements aberrant to your understanding.

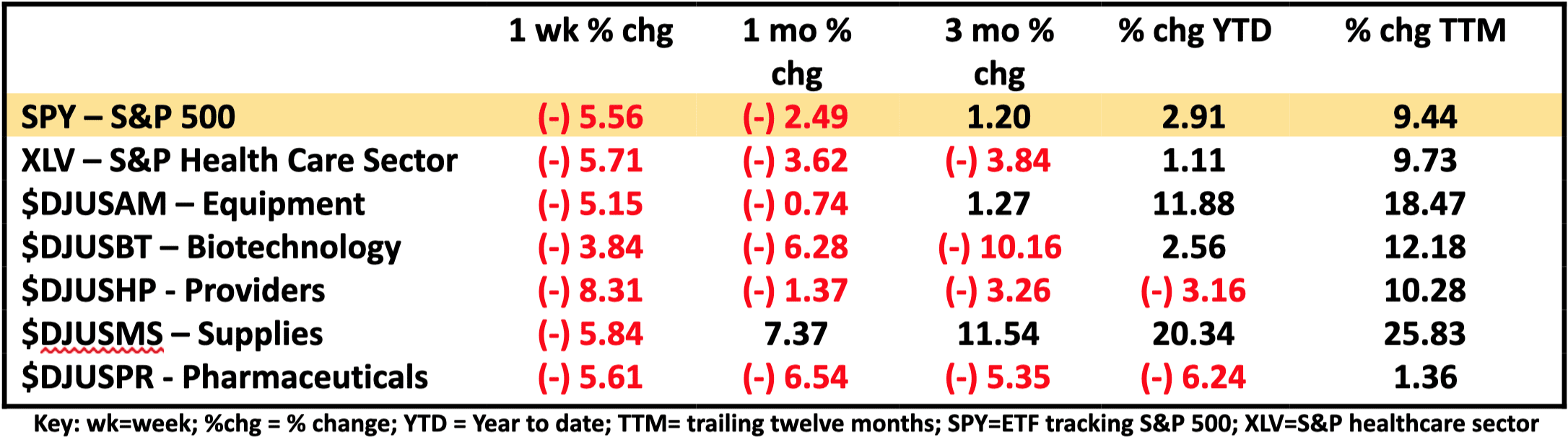

For an up-to-date analysis, see this week’s Healthcare Segment Scorecard below.

Healthcare Segment Scorecard - as of close of market 10/30/2020

In the midst of a viral pandemic governments and biopharma companies have rushed to develop a vaccine effective against SARS-CoV-2. Over 100 companies worldwide have stepped up to say they are working on something. Some are publicly traded companies and some are not. Some are in early stage development and trials and a handful are in Phase 3 trials in the US. Lots of private investment has flowed to the pre-public companies.

This intense activity has not so far led to projected value realization in the biotechnology ($DJUSBT) or pharmaceutical ($DJUSPR) segments of the healthcare market (XLV) as a whole. Medical supplies ($DJUSMS) and equipment ($DJUSAM) have been able to project actual value much sooner.

Four vaccine candidates are in Phase 3 trials in the US: Moderna (MRNA), Pfizer (PFE), AstraZeneca (AZN), and Johnson & Johnson (JNJ). Others will begin Phase 3 trials in the very near future if all goes well.

How is the market looking at these vaccine producers? It has been written that most of the gain is priced into the market but less than half of the expected gain is priced into these individual stocks. The analyst community is very bullish on this group as a whole. Hype or hope or reality? We find out together.

Year to date, value as measured by stock performance has varied widely: MRNA is +245%, PFE is (-) 5.76%, AZN is +3.47%, and JNJ is (-) 4.12%. I’m not sure I know how to completely account for this range of projected value creation. In conditions of high uncertainty, a variety of beliefs drive prices.

As I See It: This past week provided a reality check on the resurgence of the SARS-CoV-2 pandemic. While the broad measure of the healthcare market (XLV) underperforms the broader market (SPY), great anticipation exists for the development and distribution of effective vaccines. What that means for the people who receive them and the companies that produce them remains to be seen.

November 2, 2020

Bob Teague, MD

Chief Medical Officer

Green Room Technologies

Send comments or questions to [email protected]

Disclaimer: The information in Green Room Technologies’ public blogs and reports is obtained from third-party sources and believed to be reliable but accuracy and completeness are not guaranteed. Unintended errors or misprints may occur. All reports are for educational or informational purposes only and do not imply any investment, legal or other advice or recommendation. Each reader needs to review their own strategy and situation and perform their own research and analysis before using this information and opinion in any personal or corporate decision-making process or activity. All expressions of opinion are subject to change without notice. Green Room Technologies and its members are to registered investment advisors or broker/dealers and the opinions should not be construed as investment advice nor to replace advice from professional advisors.